Excerpt from this week's: Technical Scoop: Tariff Hike, Fed War, Precious Highs

Source: www.stockcharts.com

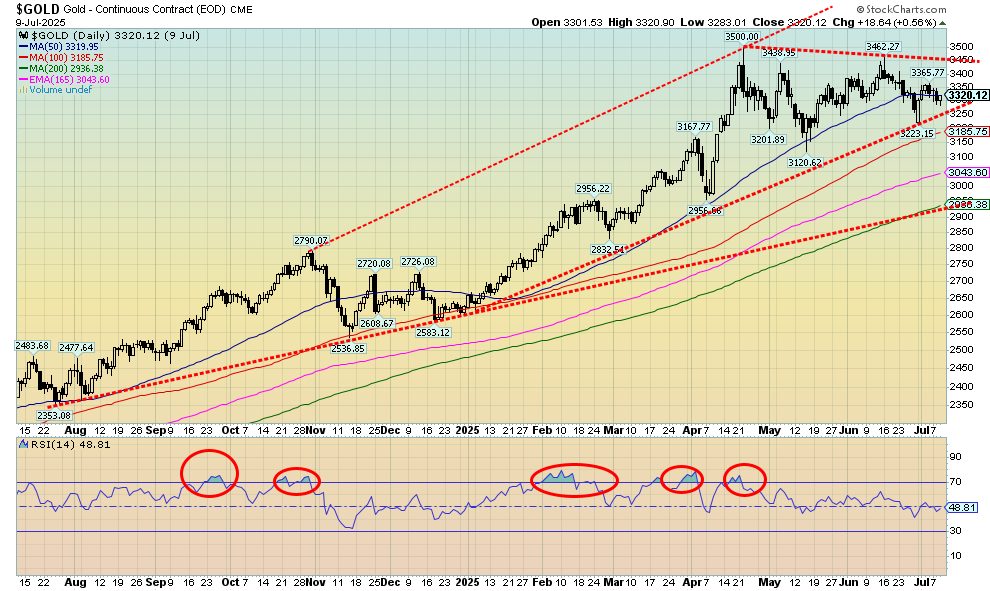

Gold continues to tantalize us as to whether it will break higher or continue in its current corrective period. The pattern is appearing as symmetrical triangle with the potential for a five-point reversal pattern that should propel us higher. Symmetrical triangles can be both continuation patterns and topping patterns. Which one is this? We lean towards a continuation pattern but are wary of a topping pattern.

The pattern can be ambiguous and, if we were to break down under $3,250 and especially under $3,200, we could see a larger drop towards $3,000, even $2,900. New highs will help as well as new highs for silver. Last Friday, July 11, 2025 silver did jump to new 52-week highs over $38. Is silver leading? The key now going forward is that gold also jumps over $3,500 and the gold stocks indices (HUI, TGD) also make new highs.

We are in a weak period for gold (and the precious metals), but hold to the potential for a July low. However, sometimes these periods also last into August, even early September, before we see the rally into October/November. All this has put us on short-term cautious alert, but we remain long-term bullish. Note that in 2024 we also had a consolidation period that lasted into August, then we rallied into October/November before another decline into December. Silver making new highs is encouraging. Now it needs to hold it.

RSIs for both gold and silver and silver are fairly neutral here, adding to the uncertainty. The gold stocks also appear to be forming a symmetrical triangle. The TSX Gold Index (TGD) needs to break out over 520 to confirm higher. A breakdown under 480 and especially 470 spells trouble with potential downside targets to 400. The TGD is showing what may be an ascending triangle which is bullish. But we need to break to new highs to confirm that. Incidently the TSX Metals & Mining Index (TGM) made all time highs this past week. An omen for gold?

Gold was our number one pick for 2025 and, so far, it has not disappointed. Percentage-wise, gold is up in 2025, along with silver. The indices are also performing very well with the HUI up percentage-wise and the TGD also up. As well, we are seeing buying in the junior miners that primarily trade on the TSX Venture Exchange (CDNX).

Other metals have been moving up as copper, platinum, palladium all made new highs this past week while copper made all-time highs. The CDNX has also been making new 52-week highs. The best part about the gold market is that, despite the new highs and the strong performance to date, we are seeing few signs of frothiness that could signal a potential top. Gold, along with silver and the precious metals, remains under-owned and under-appreciated, particularly in North America. As a friend who watches U.S. channels such as CNBC and Fox notes, they rarely ever mention gold. AI rules.

Read the FULL report here: Technical Scoop: Tariff Hike, Fed War, Precious Highs

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.