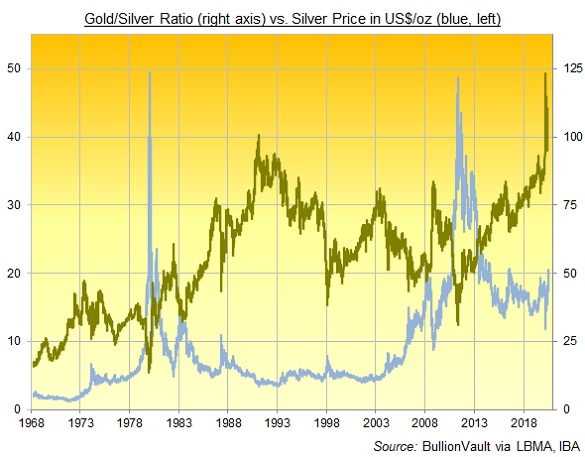

Peaking at 100 in the global economic recession of 1991, the ratio shot through that level this March, topping at 125 ounces of silver per 1 ounce of gold when the Coronavirus shutdowns of global economic activity saw the gray metal – which finds over half its end-demand from silver's industrial uses, against less than 1/10th for gold – plummet to the cheapest since 2009, down below $12 per ounce.

"Like Cinderella," says Rhona O'Connell at StoneX, the commodities, bullion and equity brokers, "silver can remain 'below stairs' for months at a time. But when it comes to life it does so with a vengeance, and like Cinderella, arrives at the party in a blaze of glory."

READ FULL ARTICLE: https://www.bullionvault.com/gold-news/silver-price-gold-072120202

July 21, 2020