Excerpt from this week's: Technical Scoop: Lonely Highs, Missed Reports, Tied Rise

Source: www.stockcharts.com

Rate cut or no rate cut, that is the question. Expectations were for a rate cut in December and the government shutdown chaos continuing. Nope. Cold water was thrown on the rate cut expectations and, officially at least, the government shutdown has ended. It may have ended but the chaos is expected to continue, certainly for a while. A lot of animosity was built up over the shutdown, which lasted a record-breaking 43 days. As well, the Epstein scandal continues to slowly envelope President Trump.

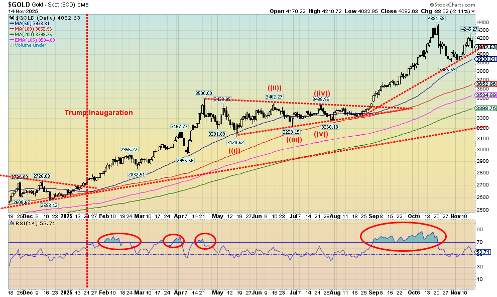

Gold was crawling back towards the all-time highs at $4,381 but then failed and Thursday/Friday saw a sell-off. Still gold managed to gain 2.0% on the week. Silver rose 4.7%, while platinum was up a small 0.2%. Palladium gained 0.4% and copper jumped 2.0%. The gold stocks were excited as the Gold Bugs Index (HUI) rose 6.2% and the TSX Gold Index (TGD) was up 6.3%. But the reversal on Thursday/Friday suggests we might not make it new highs, at least not yet. It is not clear on the gold chart, but the silver chart may have made a double top. Nonetheless, a breakdown under the recent low at $3,887 could suggest we are headed lower with possible targets down to around $3,400. There is support at $3,900, then down to $3,700.

We knew going in that the November/December period was a weak one for the precious metals. So far, we are on schedule. A final low is probably not due until December and, as noted, $3,700 might not be an unreasonable target. The RSI is neutral at 53.70. We need to get under 30 to suggest that a low might be in.

Source: www.stockcharts.com

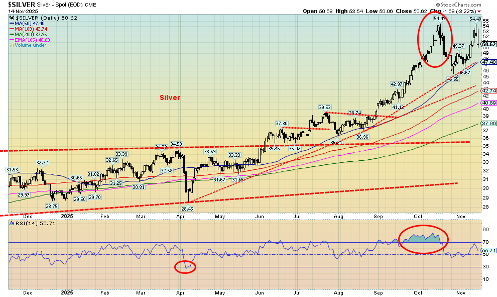

As with gold, silver rose with the government shutdown and expectations of a December rate cut. It unravelled when the shutdown ended and expectations dropped for a rate cut. Silver rose 4.7% on the week but closed Friday down 3.2% after hitting a high of $54.40. That print left us just shy of the previous high at $54.49 seen in October. This now raises the spectre of a possible double top. The neckline breaks around $47.40 and, if it is a real double top, potential targets are $38.50. Minimum targets would be $45.30 or $44. A break to $42 can’t be ruled out. Only new highs would determine the next move. And right now, we appear to be failing it. That’s the bad news, but we still expect gold/silver rally to continue into 2026.

Source: www.stockcharts.com

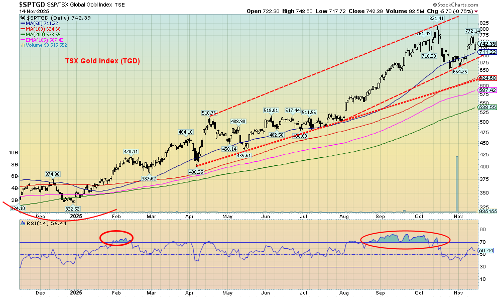

The gold stocks enjoyed a good up week with the TSX Gold Index (TGD) gaining 6.3% while the Gold Bugs Index (HUI) was up 6.2%. We also saw more positive action in the junior developer gold miners, although none were mentioned in the Liberal budget as being recipients of investment. The budget concentrated more on critical mineral projects. At the end of the week, the TGD sold off on what was probably profit-taking. The concern here is that a failure would suggest once we break back under 664 a drop to 624 is likely. Under that level we could fall further. Failure to achieve new highs on this rally is a negative sign. Of course, we haven’t broken down yet, so thoughts of new highs can stick with us. But the sell-off on Thursday/Friday was a negative sign. Only new highs above 821 would tell us the low on this correction is in.

Read the FULL report here: Technical Scoop: Lonely Highs, Missed Reports, Tied Rise

Copyright David Chapman 2025

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.