Excerpt from: Technical Scoop: Whacked Haven, Non-topped Market, Expected Inflation

Source: www.stockcharts.com

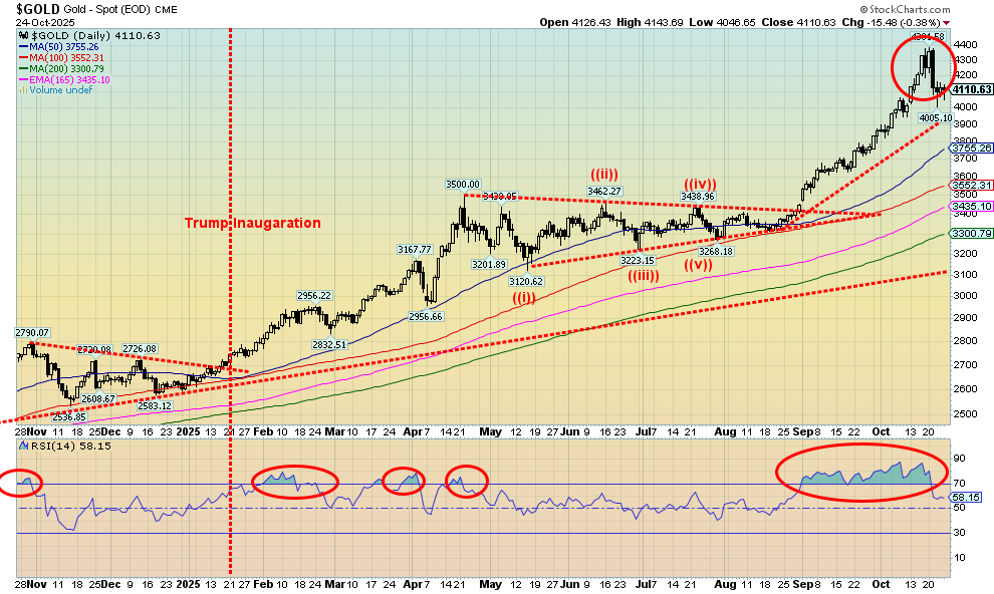

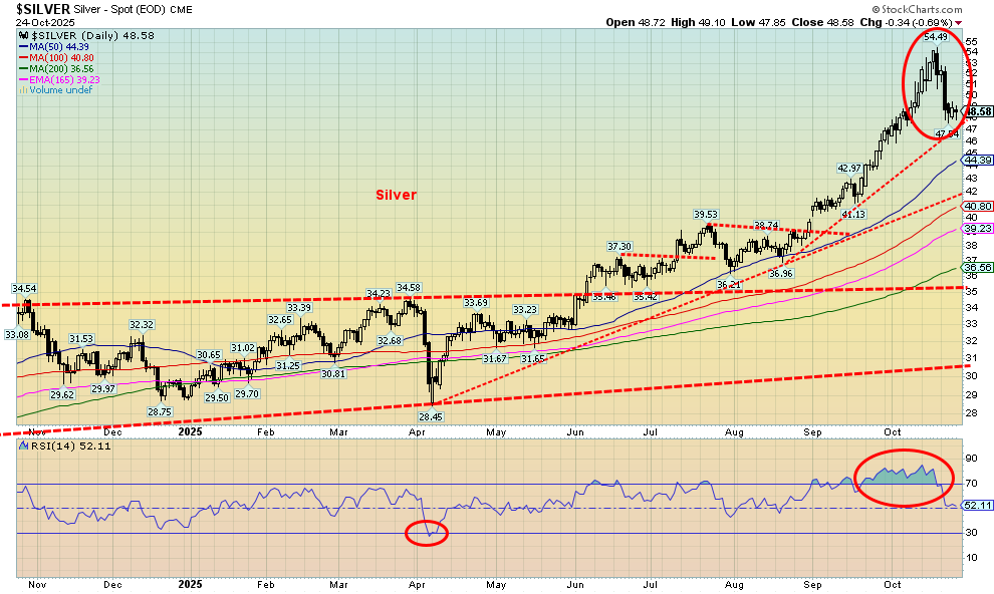

After a nine-week winning streak, gold could be excused for finally taking a break. The drop was overdue, as we had noted the prolonged period of gold being overbought. On the week, gold fell 3.2% and silver dropped 6.1%. Both remain well up on the year, with gold +55.2% and silver +66.1%. Elsewhere with the other metals, platinum fell 1.5%, palladium was down 3.5%, but copper jumped 2.6% as supply disruptions hit the metal. The collapse of a mine in the Dominican Republic, along with issues sparking closures in Indonesia and Chile, moved copper higher.

It's been a remarkable year so far for both gold and silver and the gold stocks. The gold bugs might say it’s about time. Since last November 2024, gold is up almost 62%. On the year, gold is up 55.2% and silver even more, up 66%. The gold stocks, the Gold Bugs Index (HUI), and TSX Gold Index (TGD) are both up over 100% in 2025. Many individual stocks are up even more. However, a correction was overdue as the overbought conditions had persisted since August.

Gold turned lower, despite weaker than expected inflation data and consistent expectations that the Fed will cut rates this week. The US$ Index wasn’t much of a factor as we noted it was up only 0.5%. Gold did make a new all-time high on Monday but then fell some 6% from that level.

The last important low for gold was seen in October 2023. We are now 24 months from that low, well into the current 31-month cycle. That low is not due until next May, give or take a few months. This correction has the look of just that: a correction, given the steep rise since August when we broke out over that triangle. The triangle suggested a target of $3,815 which we surpassed. The next target was $4,050 which we have also surpassed. The next target above could be $4,430. The high so far? $4,381. Not achieving our target is another sign of the correction.

We remain optimistic going forward that despite the drawdown this past week it is just a pause that could last into November, even December. Then another up move should get underway before topping and falling into April/June 2026. Targets in theory could be as high as $4,800.

Source: www.stockcharts.com

Silver has had a remarkable year, up 66% to date. Demand for silver far outpaces supply. But that didn’t stop a 6.1% decline this past week. Like gold, silver’s price rise has been dramatic and in need of a correction. A massive physical drain of silver from COMEX should have put upward pressure on silver prices. Silver remains in backwardation with the pressure on spot keeping cash prices above futures prices. Silver found support near that uptrend line from the April 2025 low at $28.45. Since that time silver rose a remarkable 91%, despite that hesitation in June through August. Silver had been making all-time highs, finally taking out the $50 highs seen in 1980 and 2011. On an inflation-adjusted basis, we still have a way to go: $197 based on the 1980 high and $72 based on the 2011 high. The latter now seems to be within the range of possibility. A break of $47 could send silver tumbling further to stronger support at $42. That would be a healthy 22% correction from the highs. We remain friendly towards higher silver prices going forward, but first we need this pause to shake out the weak longs and ease the overbought conditions.

Source: www.stockcharts.com

We know – it was overdue. Gold’s corrective decline leaned heavily on the gold stocks. The TSX Gold Index (TGD) fell 6.9% this past week while the Gold Bugs Index (HUI) dropped 7.4%. We note as well softness in the junior developers as a number of them saw profit-taking declines. The gold miners ETF GDX fell 7.5% while the junior gold miners ETF GDXJ was off 8.0%. Still, despite the declines, the TGD is still up 109% in 2025 and the HUI up 114%. It’s been a remarkable year so far for the gold bugs.

But a correction was overdue. The RSI remained in overbought zone for three months. It was an accident waiting to happen. Nonetheless, we don’t view the drop this past week as a disaster. After a long run-up, profit-taking was inevitable. There was no significant upswing in volume. The two indices tested their 50-day MA and the zone held. Any further break could send to the TGD to next support near 590/595 and the HUI near 500.

We’d become concerned if the TGD did break under 590 and the HUI under 500. That could signal a steeper and more prolonged correction. For a change during a record setting year, neither of the TGD or the HUI made new all-time highs this past week.

Read the FULL report here: Technical Scoop: Whacked Haven, Non-topped Market, Expected Inflation

Copyright David Chapman 2025

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.