The gold price took two broad and quiet steps higher in early Globex trading overseas on Friday -- and that lasted until minutes after 1 p.m. China Standard Time on their Friday afternoon. It was quietly down hill from that point until around 9:30 a.m. in London -- and then crept a bit higher until minutes after the jobs report hit the street at 8:30 a.m. in COMEX trading in New York. Its explosive rally attempts from there were finally capped at 12:30 p.m. EDT -- and it was then sold/engineered two very quiet and broad steps lower until the market closed at 5:00 p.m.

The low and high ticks in gold were reported by the CME Group as $3,565.90 and $3,626.20 in the October contract -- and $3,595.40 and $3,655.50 in December...an intraday move of $60.10 in the latter month. The October/ December price spread differential in gold at the close in New York yesterday was $29.30...December/February26 was $28.80 -- and February/April26 was $25.40 an ounce.

Gold was closed on Friday afternoon in New York at $3,585.30 spot...up $40.70 on the day -- and $13.60 off its Kitco-recorded high tick. Net volume was very heavy once again at a bit over 214,000 contracts -- and there were a bit over 24,000 contracts worth of roll-over/switch volume on top of that.

I saw that 925 gold, plus 835 silver contracts were traded in September yesterday -- and it will be of more than passing interest as to how much of that shows up in tonight's Daily Delivery and Preliminary Reports.

![]()

After getting sold lower by at bit at the 6:00 p.m. Globex open in New York on Thursday evening, the silver price also took two broad and quiet steps higher -- and that lasted until the 2:15 p.m. afternoon gold fix in Shanghai. It began to head lower from that point until it blasted higher a minute or so after 8:30 a.m. in New York. That explosive rally ran into all kinds of 'grief' -- and 'da boyz' had it under some semblance of control by 10:45 a.m. EDT. Its ensuing rally was capped around 12:30 p.m. when it touched $41 spot -- and it was sold/ engineered a bit lower until 4:30 p.m. in after-hours trading. It then rallied a nickel or so until the market closed at 5:00 p.m. EDT.

The low and high ticks in silver were reported as $41.16 and $42.10 in the December contract... an intraday move of 94 cents. The September/December price spread differential in silver at the close was down to 47.8 cents... December/March26 was 48.6 cents -- and March/ May26 was 31.6 cents an ounce.

Silver was closed in New York on Friday afternoon at $40.93 spot...up only 35 cents from Thursday -- and 42 cents off its Kitco-recorded high tick. Net volume was a bit on the heavier side at around 64,300 contracts -- and there were a bit under 5,500 contracts worth of roll-over/switch volume in this precious metal.

![]()

Platinum's rally ran into 'something' a minute or so after 12 o'clock noon in Shanghai on their Friday afternoon -- and then sank very quietly until the jobs number was released at 8:30 a.m. in New York. Its rally attempts after that were brutalized even more than silver's -- and 'da boyz' set its engineered low tick about fifteen minutes before the 11 a.m. EDT Zurich close. Its ensuing rally attempt ran into another 'something' around 12:40 p.m. -- and it was then sold quietly lower until trading ended at 5:00 p.m. EDT. Platinum was closed at $1,373 spot...down a dollar from Thursday -- and 26 bucks off its Kitco-recorded high tick.

![]()

The palladium price crawled higher until around 10:25 a.m. in Shanghai on their Friday morning -- and then began to head lower at an ever-increasing rate until it got hit further starting about ten minutes before the COMEX open in New York. its ensuing rally on the jobs report met the same fate as platinum's -- and its engineered low tick was also set at the same time...10:45 a.m. EDT. It was allowed to creep higher from that juncture until 4 p.m. EDT in the very thinly-traded after-hours session -- and was then sold a bit lower until the market closed at 5:00 p.m. Palladium was closed at $1,107 spot...down 13 dollars on the day -- and 30 bucks off its Kitco-recorded high tick.

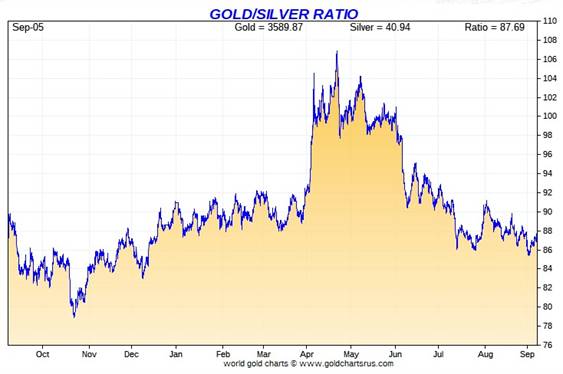

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 87.6 to 1 on Friday...compared to 87.3 to 1 on Thursday.

Here's Nick's 1-year Gold/Silver Ratio chart, updated with this past week's data. Click to enlarge.

![]()

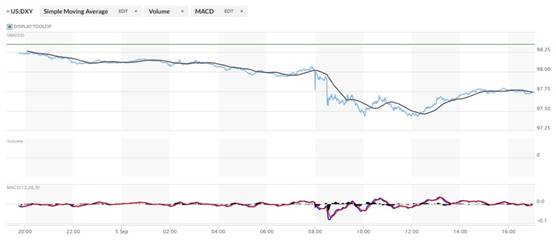

The dollar index was marked-to-close on Thursday afternoon in New York at 98.35 -- and then opened lower by 12 basis points once trading commenced at 7:45 p.m. EDT on Thursday evening...which was 7:45 a.m. China Standard Time on their Friday morning. It then edged quietly lower until around 11:50 a.m. in London...rallied a bit until a few minutes before 1 p.m. BST -- and then sank until it fell off a cliff at 8:30 a.m. in New York. That sell-off continued on and off until it began to head higher at an ever-decreasing rate starting around 12:15 p.m. EDT -- and ending at 3:50 p.m. It then sagged a bit going into the 5:00 p.m. close.

The dollar index finished the Friday trading session in New York at 97.77 ...down 58 basis points from its close on Thursday.

Here's the DXY chart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

![]()

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...97.74...and the close on DXY chart above, was 3 basis points below that. Click to enlarge.

The powers-that-be were there to ensure that the big swoon in the dollar index, along with the ugly jobs report, at 8:30 a.m. in New York was not allowed to be reflected fully in any of the precious metal prices...platinum and palladium in particular, as both were closed down on the day.

U.S. 10-year Treasury: 4.0860%...down 0.0900/(-2.16%)...as of the 1:59:53 p.m. CDT close.

The boys at the Fed were certainly very busy in the Treasury market yesterday.

The ten-year closed lower by a hefty 14.1 basis points on the week...thanks to the ongoing and increasingly obvious interventions by the Fed.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

![]()

As I continue to point out in this spot every week, the 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023 -- and it's more than obvious from the above chart that it will be kept as low as possible -- and for as long as possible.

Then there was this post on 'X' in the Friday edition of the King Report: @GlobalMktObserv: This is a staggering economic experiment. The Bank of Japan owns government bonds, ETFs, and REITs worth a WHOPPING 117% of Japan's GDP. By comparison, the European Central Bank's balance sheet size relative to GDP is 41%, and the Fed's is 22%. https://x.com/GlobalMktObserv/status/1963451956103450785

![]()

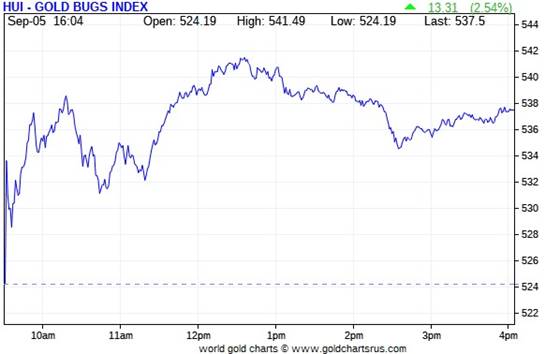

The gold stock rallied unevenly higher starting at the 9:30 opens of the equity markets in New York on Friday morning -- and their respective highs were set a few minutes after 12:30 p.m. EDT. They then headed lower until around 2:40 p.m. -- and then crept quietly higher until trading ended at 4:00 p.m. EDT. The HUI closed up 2.54 percent.

![]()

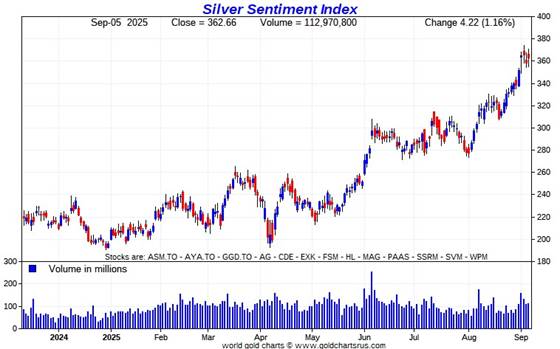

The price action/path in the silver equities was mostly similar to gold's, but obviously more subdued, as 'da boyz' were all over the silver price like white on rice yesterday. Nick Laird's Silver Sentiment Index closed higher by only 1.16 percent. Click to enlarge.

![]()

The star yesterday was Coeur Mining...closing higher by 4.04 percent respectively. It's hard to believe that any of the silver equities in the above index closed down on the day, but three of them did...led by Endeavour Silver, as it finished the Friday session down 2.44 percent on no news that I could see.

Starting next week, MAG Silver will be gone from the Silver Sentiment Index because its acquisition by Pan American Silver is now complete. I've replaced it with Peñoles.

I didn't see any news on any of the thirteen silver companies that comprise the above Silver Sentiment Index.

The silver price premium in Shanghai over the U.S. price on Friday was 4.39 percent.

The reddit.com/Wallstreetsilver website, now under 'new' and somewhat improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

Here are two of the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver Sentiment Index -- and what a sight for sore eyes they all are yet again.

There's no weekly chart because of the Labour Day holiday on Monday. Nick Laird's program uses the previous five business days to compute the weekly chart, which in this case would include Friday, August 29...making it useless. It will return in this spot next week.

Here's the month-to-date chart...only 4 days young...and I'm just happy that it's green across the board. With silver and its associated equities on a short leash, it's no surprise that gold and its equities have outperformed. Click to enlarge.

Here's the year-to-date chart -- and it's also a fetching shade of wall-to-wall green. Thanks to 'da boyz' the silver equities continue to lag on both a relative and absolute basis -- despite the fact that silver the metal is outperforming gold by a now noticeable amount...four percentage points. Click to enlarge.

Of course -- and as I also point out in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting at a new all-time high of 'whatever' dollars an ounce, like gold is sitting at its new current all-time high price of $3,585 spot...it's a given that the silver equities would be outperforming their golden cousins... both on a relative and absolute basis -- and by an absolute country mile...or two. That day, as I also keep mentioning, lies in our future -- and sometime soon, I suspect...as you'll find out a bit further down -- and in The Wrap.

![]()

The CME Daily Delivery Report for Day 6 of September deliveries showed that 500 gold, plus 519 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the only short/issuer that mattered was Morgan Stanley, issuing 425 contracts out of its house account...followed by JPMorgan, issuing 57 contracts out of its client account. There was an impressive list of long/stoppers -- and the only one that really mattered was Deutsche Bank, as it picked up 385 contracts for its house account.

In silver, there were six short/issuers in total -- and the two biggest were Wells Fargo Securities -- and JPMorgan, issuing 251 and 150 contracts respectively...the former from their house account. The largest long/stopper was JPMorgan, picking up 270 contracts for clients. After them came the CME Group, Deutsche Bank, British bank Standard Chartered and Australia's Macquarie Futures...stopping 91, 50, 48 and 44 contracts -- and all for their respective house accounts.

The CME Group reissued their as 5x91=455 of those one-thousand ounce good delivery bar micro silver futures contracts -- and the usual two long/stoppers for those were Advantage and ADM, picking up 262 and 193 contracts for their respective client accounts.

In platinum, there were 74 contracts issued and stopped -- and like on Thursday, all were issued from British bank HSBC's client account.

Month-to-date there have already been 3,626 gold contract issued/reissued and stopped...impressive for a non-scheduled delivery month -- and that number in silver is 10,534 contracts already. In platinum it's 656 contracts -- and in palladium...303.

Since the delivery month began on Tuesday, there have been an additional 1,024 gold, plus 569 silver contracts added to the September delivery month. The rush for physical continues unabated...

The link to yesterday's Issuers and Stoppers Report is here.

The CME Preliminary Report for the Friday trading session, showed that gold open interest in September increased by 230 COMEX contracts, leaving 920 still open...minus the 500 contracts out for delivery on Tuesday as mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 529 gold contracts were actually posted for delivery on Monday, so that means that 529+230=759 more gold contracts were added to September deliveries.

Silver o.i. in September rose by 33 contracts, leaving 1,150 still around... minus the 519 contracts out for delivery on Tuesday as per the above Daily Delivery Report. Thursday's Daily Delivery Report showed that only 32 contracts were posted for delivery on Monday, so that means that 33+32=65 more silver contracts were added to the September delivery month.

Total gold open interest in the Preliminary Report on Friday rose by 10,201 COMEX contracts -- but total silver o.i. declined by a counterintuitive 347 contracts. I have more on this in The Wrap.

[I checked the final total open interest numbers for the Thursday trading session -- and they showed a big decrease in gold...from +8,749 contracts, down to only +592 COMEX contracts. There was a negligible downward adjustment in silver...from -1,161 contracts, down to -1,185 contracts.]

Gold open interest in October in the Preliminary Report on Friday rose by 1,103 contracts, leaving 62,040 contracts still open -- and silver o.i. in October increased by 24 contracts, leaving 2,516 contracts still around.

The final numbers in both silver and gold open interest in October on Thursday were identical in silver from the Preliminary Report at -9 contracts -- but in gold, it decreased to -826 contracts in the final report from the CME Group on Friday morning....from -67 COMEX contracts in the Preliminary Report that came out on Thursday night.

![]()

![]()

There were no reported changes in GLD yesterday...but a further 13,860 troy ounces of gold were added to GLDM. A further 1,180,312 troy ounces/two truckloads of silver were withdrawn from SLV, or the equivalent number of shares were redeemed for physical metal.

The SLV borrow rate started the Friday session at 0.71% -- and finished it at 0.80%... with only 650,000 shares available to short. The GLD borrow rate began the day at 0.27% -- and closed at 0.35%...with 5.2 million shares available.

In other gold and silver ETFs and mutual funds on Earth on Friday...net of any changes in COMEX, GLD, GLDM and SLV activity, there were a net 226,000 troy ounces of gold added -- and a net 3,182,666 troy ounces of silver were added as well. The largest 'in' amount in silver were the 4,110,528 troy ounces added to iShares/SSLN -- and the biggest reported withdrawal were the 1,668,082 troy ounces removed from Purpose/SBT...which Nick is checking to ensure that this number is accurate.

There was no sales report from the U.S. Mint yesterday -- and nothing month-to-date, either.

![]()

![]()

For the third straight day there was no in/out movement in gold over at the COMEX-approved depositories on Thursday -- and no paper activity, either. The link to all those zeros is here.

It was another busy day in silver, however...as 1,075,315 troy ounces were received...all of which ended up at Loomis International -- and 120,568 troy ounces were shipped out.

In the 'out' category, the largest amount were the 74,781 troy ounces that left Brink's, Inc...with the rest...45,786 troy ounces...departing StoneX. There were 49,720 troy ounces transferred from the Eligible category and into Registered over at Manfra, Tordella & Brookes, Inc.

The link to all of Thursday's considerable COMEX silver action is here.

The Shanghai Futures Exchange reported that a net and further 175,544 troy ounces of silver were added to their inventories on Friday...which now stands at 40.684 million troy ounces.

![]()

Nick passed around a couple of charts that I don't have room for in today's column. They show gold and silver withdrawals from the Shanghai Gold Exchange -- and updated with August's data.

During that month, there were a net 84.971 tonnes/2.732 million troy ounces of gold taken out -- and in silver, that number was 163.215 tonnes/5.248 million troy ounces shownwithdrawn as well. I'll have the charts for you on Tuesday.

![]()

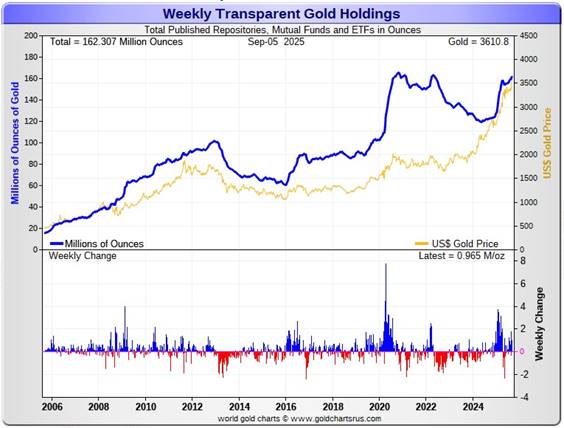

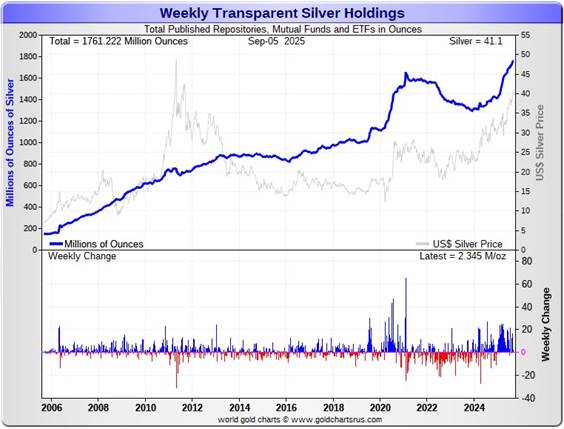

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the business week just past, there were a net 1.144 million troy ounces of gold added -- but only a net 2.345 million troy ounces of silver were added. That silver number would have been far higher if it hadn't been for the withdrawals/conversion of shares for physical over at SLV this past week. Click to enlarge.

According to Nick Laird's data on his website, a net 3.099 million troy ounces of gold were added to all the world's known depositories, mutual funds and ETFs during the last four weeks-- with the largest 'in' amount by far being the 1.074 million troy ounces added to GLD -- followed by the 430,000 troy ounces added to five different iShares gold ETFs. The next largest 'in' amount were the 258,000 troy ounces deposited into Invesco SGLD.

As I continue to point out in this space, despite the fact that we're now north of $3,500 in gold -- and at a new record high, the amount of gold held by all the world's mutual funds, depositories and ETFs is still a bit below its all-time high set back in late 2020.

However, it should be also be carefully pointed out that despite the fact that silver is still some distance away from its previous $50 nominal high of April 2011...the amount of silver held in all these depositories, ETFs and mutual funds is now a noticeable amount above its old all-time high inventory level of January 2021.

Except for the odd week here and there, there have been 31 almost consecutive weeks/almost 8 months of net silver inflows into all the world's depositories, ETFs and mutual funds. As I keep saying in this space, there are obviously some deep-pocket silver stackers out there that know what we know -- and probably know more than we know as well. I have much more on this in The Wrap.

A net 40.997 million troy ounces of silver were added during that same 4-week time period... with the largest net 'in' amount being the 11.875 million troy ounces added to the COMEX... followed by the net 6.528 million troy ounces added into SLV. That's followed by the more than ten Indian silver ETFs ...with 5.043 million troy ounces added -- along with the 5.104 million oz. into iShares/SSLN. Next was Aberdeen, as they added 4.220 million troy ounces into their various silver ETFs -- and the list goes on and on. There were no 'out' amounts worth mentioning.

For reasons that continues to escape me -- and everyone else in the precious metals space, retail bullion sales remain moribund, with U.S. Mint sales being the poster children for that, as mentioned earlier. John Q. Public is still nowhere in sight -- although the big institutional investor continue making their presence felt in the various ETFs and mutual funds...silver in particular. But it has picked up in gold the past few weeks.

At some point there will be ever larger quantities of silver and gold required by all the rest of these ETFs and mutual funds once serious institutional buying really kicks in -- and there have been significant signs of that across the board in silver over the last month or so.

However, the really big buying lies ahead of us when the silver price is finally allowed to rise substantially, which I'm sure is something that the powers-that-be in the silver world are more than aware of -- and it's now $42 that's the new and obviously temporary line in the sand for silver.

And as Ted Butler stated some time ago, it stands to reason that JPMorgan has parted with virtually all of the one billion plus troy ounces that they'd accumulated since the drive-by shooting that commenced at the Globex open at 6:00 p.m. EDT on Sunday, April 30, 2011.

It's pretty much a given that most of the silver flown into the COMEX from London so far this year came from their stash. I'm sure they've been supplying the silver that's flowing into the rest of world's ETFs and mutual funds too...including what's been going into the COMEX, SLV, Aberdeen, and PSLV -- plus all the rest.

Little has changed from last week, as the physical demand in silver at the wholesale level continues very strong -- and COMEX silver deliveries have been huge all year...including the current scheduled delivery month... September...where just under 53 million troy ounces have already been issued and stopped on the COMEX so far during the first first full delivery week of the month. The amount of silver being physically moved, withdrawn, or changing ownership remains very elevated.

This demand will continue until available supplies are depleted...which will most likely be the moment that JPMorgan & Friends stop providing silver to feed this deepening structural deficit, now well into its fifth year according to the ongoing reports from The Silver Institute.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 197.1 million troy ounces...up 2.1 million troy ounces from last week -- and a great distance behind the COMEX, the largest silver depository, where there are 518.4 million troy ounces being held...up only a net 200,000 troy ounces this past week...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 107 million troy ounce mark...quite a bit different than the 210.3 million they indicate they have...unchanged for the last eight weeks in a row.

PSLV remains a very long way behind SLV as well -- as they are now the second largest silver depository after the COMEX, with 488.5 million troy ounces as of Friday's close...down 3.0 million ounces from last week.

The latest short report [for positions held at the close of business on Friday, August 15] showed that the short position in SLV increased by a hefty 19.37%...from the 45.22 million shares sold short in the prior report...up to 53.97 million shares in this latest short report that came out ten days ago...9.97 percent of total SLV shares outstanding. This amount remains grotesque, obscene -- and fraudulent beyond description...as there is no physical silver backing any of it as the SLV prospectus requires.

BlackRock issued a warning five or so years ago to all those short SLV that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it.

The next short report...for positions held at the close of trading on Friday, August 29 will be posted on The Wall Street Journal's website on Wednesday evening EDT on September 10 -- and I'm already bracing myself for another big increase.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well.

The latest OCC Report for Q1/2025 came out a bit over two months ago now -- and it showed that the precious metal derivatives held by the four largest U.S. banks only increased by around $20 billion/3.90% from Q4/2024.

JPMorgan's precious metals derivatives rose from $287.0 billion, up to $323.5 billion in Q1/2025...whereas Citigroup's fell from $163.4 billion...down to $142.8 billion. BofA's rose from $57.7 billion, up to $61.7 billion -- and the derivatives position held by Goldman Sachs is a piddling and immaterial $269 million -- down from the $350 million held in Q4/2024.

But with JPMorgan holding 61% of all the precious metals derivatives... Citibank holding 27% -- and Goldman about 10% of the total of the four reporting banks, it's only the first two banks that matter.

As I keep pointing out in this spot every weekend, the OCC indicator is flawed for two very important reasons, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others... that are card-carrying members of the Big 8 shorts. Now the list is down to just four banks...so a lot of data is hidden...which is certainly the reason why the list was shortened. On top of that, the list doesn't include the non-U.S. banks that are members of the Big 8 shorts: British, French, German, Canadian -- and Australian.

However, yesterday's Bank Participation Report has blow all of what's contained in that last paragraph totally out of the water -- and you can read about it further down -- and in The Wrap.

![]()

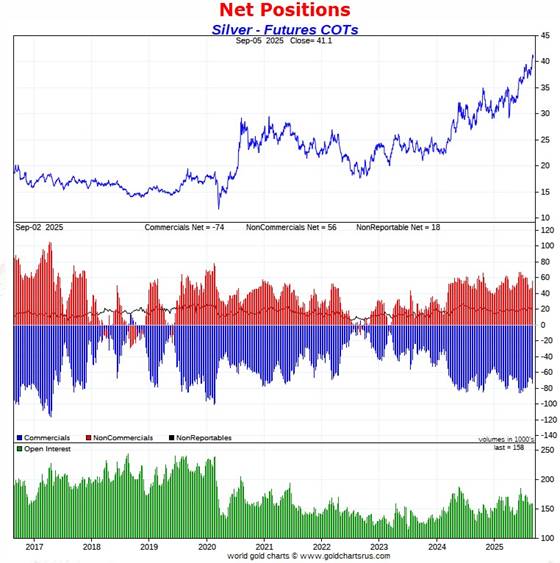

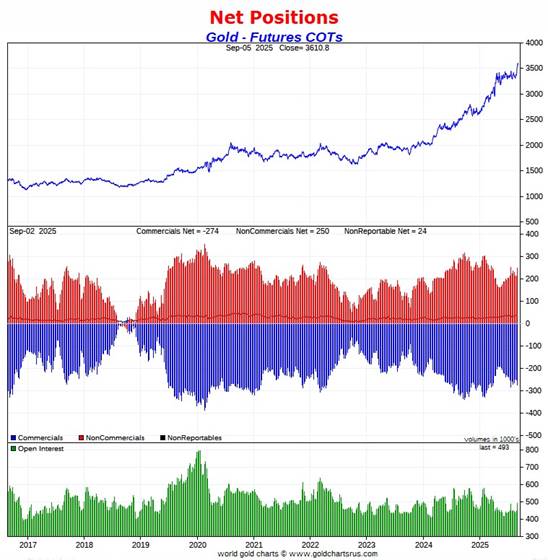

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, showed the expected big increases in the short positions in both silver and gold -- and in the former, it was all Ted's raptors, the small commercial traders other the than the Big 8, that went massively short. In gold, it was 'all for one -- and one for all' in the commercial category.

In silver, the Commercial net short position rose by 5,912 COMEX contracts... 29.560 million troy ounces of paper silver. But considering the price action, it could have been far worse.

They arrived at that number through the sale of 6,013 long contracts...but also bought back 101 short contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was the Managed Money and Other Reportables that were the big buyers during the reporting week just past...as the former increased their net long position by 5,799 COMEX contracts...while the latter increased theirs by 3,658 contracts. This meant that the traders in the Nonreportable/small traders had to have reduced their net long position -- and they did...by 3,545 COMEX contracts.

Doing the math: 5,799 plus 3,658 minus 3,545 equals 5,912 COMEX contracts...the change in the Commercial net short position.

The Commercial net short positionin silver now stands at 74,197 COMEX contracts/370.985 million troy ounces, up those 5,912 contracts from the 68,285 COMEX contracts/341.425 million troy ounces that they were short in last Friday's COT Report -- and obviously still very bearish.

But the Big 4 shorts only increased their net short position by a piddling 81 contracts...from 47,271 contracts, up to 47,352 contracts...which is still their smallest short position since way back on 26 April 2024.

The Big '5 through 8' shorts actually decreased their net short position, them by a rather inconsequential 201 contracts...from the 22,055 contracts in last Friday's COT Report, down to 21,854 contracts in yesterday's COT Report -- and still about 10,000 contracts higher than 'normal'. The short position of this group of traders has barely move in the last eight weeks -- and is actually down about a thousand contracts from the 15 July COT Report.

The Big 8 shorts in total decreased their overall net short position from 69,321 contracts, down to 69,206 COMEX contracts week-over-week...a drop of 115 COMEX contracts...their smallest short position since December 6, 2024. But the fact that it declined, instead of rising significantly, is not a miracle...which I'll get into below the chart.

But since the Commercial net short position rose by 5,912 contracts in yesterday's COT Report -- and the Big 8 decreased their net short position by 115 contracts, this meant that Ted's raptors...the small commercial traders other than the Big 8...had to have been monster sellers during the reporting week -- and they were. They held a long position of 1,036 contracts in last week's COT Report -- and are now short 4,991 contracts in this week's report. They sold the sum of those two numbers during the reporting week ...6,027 COMEX contracts.

Here's Nick's 9-year COT chart for silver -- updated with the above data. Click to enlarge.

Well, you could have knocked me over with a feather when I saw that the Big 8 actually reduced their net short position on silver's big price rise during the reporting week. It turned out to be Ted's raptors that fell on their swords to the tune of 6,027 COMEX contracts.

There's only one possible explanation for this -- and that's because the raptors were instructed to sell short...as it's now obvious that the Big 8 are not about to increase their short positions going forward...regardless of what the price of silver rises to. Remember that they're partners in the 'collusive commercial traders of whatever stripe' crime family -- and that was fully on display for all to see in this report.

And whether that pattern will include the current reporting week that's still in progress, won't be known until we see next Friday's COT Report -- and there's still two more trading days left in it.

The other thing that I found interesting was the fact that the Nonreportable/ small traders decreased their long position in silver [and also gold] during this reporting week -- and it's safe to assume that it was the same trader involved in both. In the case of silver, they did so...not by selling long contracts...but through the sale of 3,894 short contracts. In gold, these traders added 12,209 short contracts. WTF?

Normally these small traders would be going massively long on silver's rally ...but the fact that they went short instead, reeks of 'not-for-profit' selling.

[NOTE: I wrote 'all of the above' long before I looked at the new Bank Participation Report that also came out yesterday -- and what it showed was stunning...explaining everything. I have more on this below -- and an extensive discussion about it in The Wrap.]

The Big 8 are short 43.7 percent of total open interest in the COMEX futures market...unchanged from the 43.7 percent they were short in last week's COT Report. This is no surprise considering that their short position barely moved -- and the change in total open interest used to calculate that number was down an immaterial 262 contracts.

However, nothing has changed with regards to that ongoing and deepening structural deficit in the physical market...which is now well into its fifth consecutive year, according the Silver Institute.

Not to be forgotten -- and which also has a huge and negative impact on the silver price, is the outrageous and grotesque short position in SLV...now up to 53.97 million shares/troy ounces...9.97% of the total shares outstanding...as of the most recent short report that came out ten days ago. Not one of those ounces sold short has any physical silver backing it as BlackRock's prospectus requires. What would the silver price be if those short SLV had to go into the open market and buy the physical metal to back those shares? Just asking.

The next short report, for positions held at the close of COMEX trading on Friday, August 29 will be posted on the WSJ's website on Wednesday evening EDT on September 10.

![]()

In gold, the commercial net short position increased by 22,933 COMEX contracts, or 2.293 million troy ounces of paper gold. It could have been worse...but the Nonreportable/small traders category made up for it...like they did in silver.

They arrived at that number through the purchase of 1,011 long contracts... but they also sold 23,944 short contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was exactly the same as it was in silver...the Managed Money and Other Reportables added hugely to their net long positions...the former by 19,585 contracts -- and the latter by 15,634 COMEX contracts. The Nonreportable/small traders decreased their net long position massively....by 12,286 COMEX contracts -- and virtually all of it came about because they sold 12,209 short contracts. Why would they do that?

The commercial net short position in gold now sits at 273,898 COMEX contracts/27.390 million troy ounces of the stuff, up those 22,933 contracts from the 250,965 contracts/25.097 million troy ounces they were short in last Friday's COT Report.

The Big 4 shorts in gold increased their net short position by 7,401 contracts this reporting week...from the 129,134 contracts they were short in last Friday's COT report, up to 136,535 contracts in yesterday's report...which is far below the obscene 198,271 contracts they were net short in the January 21 COT Report. This is their smallest short position since August 8...which is meaningless.

The Big '5 through 8'shorts also increased their net short position...from the 85,202 contracts they were short in the last COT Report, up to 90,695 contracts held short in the current report...an increase of 5,493 COMEX contracts...exceedingly bearish for them.

The Big 8 short position rose from 214,336 COMEX contracts/21.434 million troy ounces in the last COT Report...up to 227,230 contracts/22.723 million troy ounces in yesterday's report... an increase of 12,894 COMEX contracts.

But since the commercial net short position rose by 22,933 COMEX contracts during the reporting week -- and the Big 8 commercial short position increased by only 12,894 COMEX contracts, that meant that Ted's raptors...the small commercial traders other than the Big 8...had to have been sellers during the reporting week. They were, for the second week in a row...increasing their grotesque short position by a further 22,933-12,894=10,039 COMEX contracts.

The raptor short position is now up to 46,668 contracts...an increase from the 36,629 contracts they were short in last Friday's COT Report...well below the obscene 76,723 contracts they were short back on February 14...but still grotesque nonetheless.

Here's Nick's 9-year COT chart for gold -- and updated with the above data. Click to enlarge.

So it was 'all for one -- and one for all' in the collusive commercial category, as they all took part in the orgy of selling against the Managed Money traders et al.

And I'm still mightily suspicious of who that trader in the Nonreportable/small trader category was that added 12,209 short contracts in gold during the reporting week...as the act of that much selling, certainly helped the commercial traders to keep the gold price from exploding. The same can be said about that same trader in silver that sold 3,894 short contracts in it.

From a COMEX futures market perspective, the set-up in gold is market neutral at best for the Big 8 shorts -- and that's being kind...but bearish to very bearish when you add in in the big short positions held by Ted's raptors, which one has to do.

The Big 8 collusive traders in gold are short 46.1 percent of total open interest in the COMEX futures market...down quite a bit from the 48.3 percent they were short in last Friday's COT Report. But only down [and not up big] because of the huge 49,148 contract/ten percent increase in the the total open interest in gold during the reporting week, which obviously affects the percentage calculation.

But once you add in the considerable short position of Ted's raptors...46,668 contracts... the commercial net short position in gold...all held by the collusive bullion banks and commodity trading houses, et al...now represents 55.6% of total open interest...down a bit from the 56.6% of total open interest they were short in last Friday's COT Report. And only down and not up big, because of that aforesaid mentioned huge 10% increase in total open interest in the previous paragraph.

This, like the silver number, is an obvious obscene and manipulative amount.

As it has been for 50+ years, the short positions of the collusive commercial traders remains the cork in the bottle -- and standing in the way of their actual free-market prices which, in the case of silver, is some rather spectacular 3-digit number.

The unbooked margin call losses of the shorts in gold and silver is now somewhere north of $50 billion -- and despite that fact, any attempt to cover by the small traders, has run into 'da boyz' immediately.

![]()

In the other metals, the Managed Money traders in palladium decreased their net short position by by 216 COMEX contracts -- but remain net short palladium by 6,398 contracts. Their gross short position is 10,824 COMEX contracts for whatever reason...the largest short position by far of any other category. As I've been saying for a while now, I have no idea why they're short this precious metal.

The commercial traders in the Swap Dealers category are netlong palladium by 3,742 contracts...while the traders in the Producer/Merchant category are net short 1,636 COMEX contracts. The traders in the Other Reportables and Nonreportable/small trader categories remain net long palladium by very respectable amounts -- but both reduced their net long positions this past reporting week.

And it shouldn't be forgotten that the world's banks are net long 5.3 percent of total open interest in palladium in the COMEX futures market as of the September Bank Participation Report that came out yesterday...up from the 3.7 percent they were net long in the August BPR.

In platinum, the Managed Money traders increased their net long position by a further 2,711 COMEX contracts during the reporting week -- and are now net long platinum by 16,084 COMEX contracts.

The commercial traders in the Producer/Merchant category are net short 19,557 COMEX contracts -- and the Swap Dealers in the commercial category remain on the short side by 2,873 contracts in yesterday's COT Report...after being net long 3,117 contracts seven weeks ago...so they were aggressively selling into platinum's big rally. The traders in the Nonreportable/small trader category remain net long platinum by a very respectable amount...but the traders in the Other Reportables category are down to a net long position of only 914 COMEX contracts.

It's mostly the world's banks in the Producer/Merchant category that are 'The Big Shorts' in platinum in the COMEX futures market, as per September's Bank Participation Report that came out yesterday. But the U.S. banks have cut their short position drastically -- and I have more on this further down.

In copper, the Managed Money traders increased their net long position by a further 6,802 contracts -- and are net long copper by 35,556 COMEX contracts ...about 889 million pounds of the stuff as of yesterday's COT Report...up from the 719 million pounds they were net long copper in last Friday's COT report.

Copper, like platinum and palladium, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 48,071 copper contracts/1.202 billion pounds -- while the Swap Dealers are net long 14,121 COMEX contracts/353 million pounds of the stuff.

Whether this dichotomy in copper means anything or not, will only be known in the fullness of time. Ted said it didn't mean anything as far as he was concerned, as they're all commercial traders in the commercial category. This bifurcation has been in place for as many years as I've been keeping records -- and that's a very long time.

In this vital industrial commodity, the world's banks...both U.S. and foreign...

are now net long only 0.9 percent of the total open interest in copper in the COMEX futures market as shown in the September Bank Participation Report -- and down a bit from the 3.1 percent they were net long in August's.

At the moment it's mostly the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/Merchant category, as the Swap Dealers are net long, as pointed out above.

The next Bank Participation Report is due out on Friday, October 10.

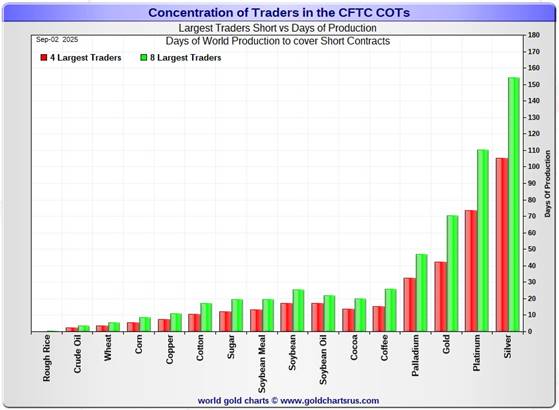

![]()

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, September 2. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short 105 days of world silver production... unchanged from the prior COT report. The ‘5 through 8’ large traders are short an additional 49 days of world silver production... unchanged from the prior COT Report, for a total of 154 days that the Big 8 are short -- also unchanged from last Friday.

This 'no changes' is no surprise, because the short position of the Big 8 barely moved...down 115 contracts week-over-week.

Those 154 days that the Big 8 traders are short, represents around 5.1 months of world silver production, or 346.030 million troy ounces/69,206 COMEX contracts of paper silver held short by these eight commercial traders ...which still remains off-the-charts grotesque. Only one of these is a U.S. bank...as per the September's Bank Participation Report that came out yesterday. This is now true of platinum and palladium as well. Much more on this further down.

The small commercial traders other than the Big 8 shorts, Ted's raptors, were sellers for the third week in a row...as they sold massively. This took them from a net long position of 1,036 contracts in last Friday's COT Report...down to a net a net short position of 4,991 contracts in yesterday's COT Report. But it was how that happen, that was the eye-opener.

Now all categories of commercial traders in both silver and gold are net short in the COMEX futures market...something that hasn't happened for many, many moons.

In gold, the Big 4 are short about 42 days of world gold production...up about 2 days from last Friday's COT Report. The Big '5 through 8' are short an additional 28 days of world production...and also up about 2 days from last Friday...for a total of 70 days of world gold production held short by the Big 8 -- and obviously up about 4 days from last Friday's COT Report.

As mentioned further up, the Big 8 commercial traders are net short 43.7 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, exactly unchanged from the 43.7 percent they were net short in last Friday's COT Report. This is no surprise, as the Big 8 short position declined by a tiny 115 contracts week-over-week as I mentioned a few paragraphs ago.

In gold, it's 46.1 percent of the total COMEX open interest that the Big 8 are net short, down from the 48.3 percent they were short last week. And down [and not up big] because of the huge 10% increase in total open interest, which obviously affects the percentage calculation.

And as I mentioned further up in the COT discussion in gold, the short position of Ted's raptors is now back to being a huge factor once again in the total commercial net short position. Adding in their 46,668 contract current short position, increases the commercial net short position to 55.6 percent of total open interest. So their short position represents 55.6-46.1=9.5 percentage points of total open interest...which is enormous -- and getting larger.

And I'll point out once again that the short interest position in SLV now sits at 53.97 million shares as of the last short report that came out about ten days ago, for positions held at the close of COMEX trading on Friday, August 15 -- up a hefty 19.37% from the 45.22 million shares sold short on the NYSE in the prior report. This number remains off-the-charts grotesque and obscene -- and yet another way that 'da boyz' are keeping a lid on the silver price, as I mentioned further up.

The next short report is due out on Wednesday, September 10...for positions held at the close of business on Friday, August 29 -- and I'm already fearful of what it might contain.

In the overall, the short position of the Big 8 commercial traders in silver was unchanged on the reporting week...a huge positive surprise considering the big rally in silver. The Big 8 shorts in gold increased their short positions by a bunch. The set up in silver from a COMEX futures market perspective remains bearish in some respects -- and in gold, it's market neutral at best for the Big 8 shorts...but bearish to very bearish when you add in the short positions of Ted's raptors.

As Ted Butler had been pointing out ad nauseam, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward...although that big short position in gold held by Ted's raptors is back to being a major factor once again.

But as he also pointed out over the years, there will come a time when what the numbers show in the COT Report won't matter, as events in the real world will overtake them -- and that time appears to be fast approaching. What the financial powers-that-be do then in order to save the shorts...especially the 'too big to fail' shorts...when that time comes, will be of more than passing interest. I have much more to say about this in The Wrap.

![]()

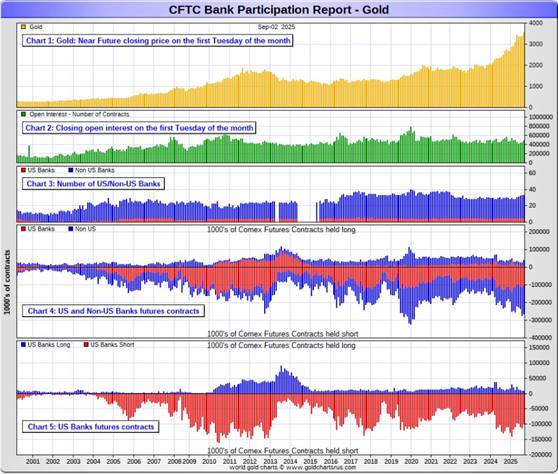

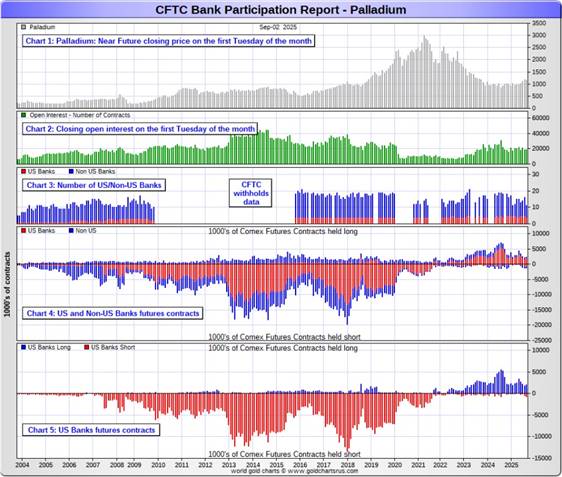

The September Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report data. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday’s cut-off in all COMEX-traded products.

For this one day a month we get to see what the world’s banks have been up to in the precious metals. They’re usually up to quite a bit -- and they certainly were again this past month. It was shocking in silver -- and to a lesser degree in silver.

[The September Bank Participation Report covers the four-week time period from August 5 to September 2 inclusive]

In gold, 5 U.S. banks are net short 91,590 COMEX contracts, down 11,503 contracts from the 103,093 contracts that these same 5 U.S. banks were net short in the August BPR.

Also in gold, 28 non-U.S. banks are net short 134,067 COMEX contracts, a decline of 10,409 contracts from the 144,476 contracts that these same 28 non-U.S. banks were short in August's BPR.

At the low back in the August 2018 BPR...these non-U.S. banks held a net short position in gold of only 1,960 contacts -- so they've been back on the short side in a gargantuan way ever since. Only a handful of these banks hold meaningful short positions in gold. The short positions of the rest are of no consequence -- and never have been.

Although a lot of the largest U.S. and foreign bullion banks are in the Big 8 short category, some of the hedge fund/commodity trading houses are short grotesque amounts of gold in that category as well. There's also the possibility that the BIS could be short gold in the COMEX futures market as well.

As of September's Bank Participation Report, 33 banks [both U.S. and foreign] were net short 45.8 percent of the entire open interest in gold in the COMEX futures market...down from the 55.1 percent that these same 33 banks were net short in the August BPR. Despite the decline, this remains an obscene and manipulative short position.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

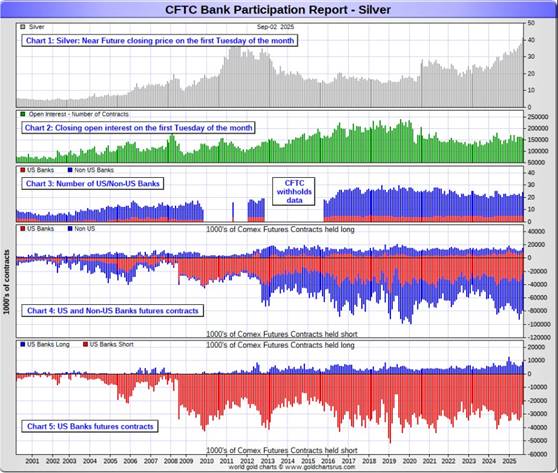

In silver, 5 U.S. banks are now net short only 13,779 COMEX contracts, down a stunning 12,137 contracts from the 25,916 contracts that these same 5 U.S. banks were net short in the August BPR...a whopping 47.5% month-over-month decline -- and the smallest short position they've held since the June 2019 BPR. My jaw hit the floor -- and I'll have more to say about this later.

The five U.S. banks that are net short silver would be Citigroup, Wells Fargo, Bank of America, Goldman Sachs -- and Morgan Stanley, or maybe JPMorgan in its stead.

Also in silver, 19 non-U.S. banks are net short 49,746 COMEX contracts, up 3,819 contracts from the 45,927 contracts that 16 non-U.S. banks were net short in the August BPR.

It's a given, based on silver deliveries so far this year, that HSBC, Barclays, Standard Chartered, BNP Paribas and Macquarie Futures hold by far the lion's share of the short positions of these non-U.S. banks. Canada's Bank of Montreal is card-carrying member of this group as well.

And, like in gold, the BIS could also be actively shorting silver. However, the remaining short positions divided up between the rest of the small handful of non-U.S. banks, are immaterial — and have always been so....the same as most of the 20-odd non-U.S. banks in gold as well.

As of September's Bank Participation Report, 24 banks [both U.S. and foreign] were net short 40.1 percent of the entire open interest in silver in the COMEX futures market — and down from the 44.6 percent that 21 banks were net short in the August BPR.

But the big takeaway in silver this month was the implosion of the short position by the U.S. banks...now down to 8.7 percent of total open interest -- and maybe less since the cut-off.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

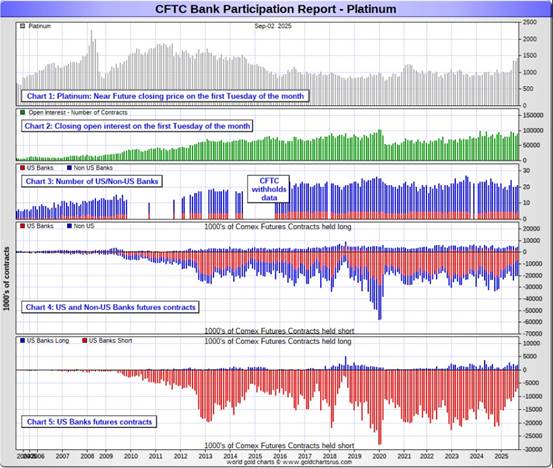

In platinum, 5 U.S. banks are net short 4,887 COMEX contracts in the September BPR, down a further 1,735 contracts from the 6,622 contracts that 4 U.S. banks were short in the August BPR. This is the smallest short position the U.S banks have held since October 2018.

At the 'low' back in September of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts...so they still have a bit more work to do to get back to market neutral...but they've been making great progress in that direction over the last four months -- and have most likely made even more progress since the Tuesday cut-off.

Also in platinum, 16 non-U.S. banks increased their net short position by a smallish 736 contracts... from 9,952 contracts held by 15 banks in August's BPR...up to 10,688 contracts in the September BPR...and almost 4.5x the amount they held short in the May BPR.

Back in the December 2023 BPR, these non-U.S. banks were net short a microscopic 35 platinum contracts...so they have yeoman work to do if they ever want to get back to that number.

As you know, platinum remains the big commercial shorts No. 2 problem child after silver -- and there's now a long-term structural deficit in it [and palladium] as well.

And as of September's Bank Participation Report, 21 banks [both U.S. and foreign] were net short 17.5 percent of platinum's total open interest in the COMEX futures market, down from the 20.6 percent that 20 banks were net short in August's BPR. I have more on this in The Wrap as well.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

In palladium, 4 U.S. banks are net long 1,287 COMEX contracts in the September BPR, up 139 contracts from the 1,148 contracts that 5 U.S. banks were net long in the August BPR.

Also in palladium, 7 non-U.S. banks are net short by 303 COMEX contracts... down from the 435 contracts that 11 non-U.S. banks were net short in the August BPR.

This is the third month in a row that these non-U.S. banks have been on the short side in palladium. But it doesn't mean a thing considering how microscopic the amount is...especially when divided up between 7 banks.

And as I've been commenting on for almost forever, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest in yesterday's COT Report was only 18,624 contracts...compared to 88,805 contracts of total open interest in platinum...158,368 contracts in silver -- and 492,908 COMEX contracts in gold.

Total open interest in palladium has increased quite a bit over the last number of years, because I remember when it was less than 9,000 contracts on average. So it's nowhere near as illiquid as it used to be -- and it's also been helped along by the fact that the bid/ask is now down to only 20 bucks. It used to be $150 at one point way back when.

As I say in this spot every month, the only reason that there's a futures market at all in palladium, is so that the Big 8 commercial traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 11 banks [both U.S. and foreign] are net long 5.3 percent of total open interest in palladium in the COMEX futures market...up from the 3.7 percent of total open interest that 16 banks were net long in the August BPR.

For the last 5 years or so, the world's banks have not been involved in the palladium market in a material way...see its chart below. And with them still net long, it's almost all hedge funds and commodity trading houses that are left on the short side. The Big 8 shorts, none of which are banks, are net short 46.0 percent of total open interest in palladium as of yesterday's COT Report...up from the 39.8 percent they were short in August's BPR.

Here’s the palladium BPR chart. Although the world's banks are net long at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium -- and now platinum and silver, and almost all of the non-U.S. banks in gold...only a handful of the world's banks, most likely no more than a dozen or so in total -- and mostly U.S. and U.K.-based...along with French bank BNP Paribas...continue to hold meaningful short positions in the other three precious metals...although I won't let Canada's Bank of Montreal or Australia's Macquarie Futures off the hook just yet...nor Deutsche Bank in gold.

However, the big implosion in the U.S. banks' short positions in silver, along with the huge decline in their short position in platinum, are the standout features in this month's Bank Participation Report -- and should be duly noted.

As I pointed out above, some of the world's commodity trading houses and hedge funds are also mega net short the four precious metals...far more short than the banks in some cases. They have the ability to affect prices if they choose to exercise it. But it's still the collusive Anglo/American/Western bullion bank cartel in the commercial category that are at Ground Zero of the price management scheme in the COMEX futures market...but with the influence of the 5 U.S. banks now vanishingly small, except for gold.

And as has been the case for a couple of decades now, the short positions held by the Big 4/8 traders is the only thing that matters...especially the short positions of the Big 4...or maybe only the Big 1 or 2 in both silver and gold. How this is ultimately resolved [as Ted kept pointing out] will be the sole determinant of precious metal prices going forward.

The collusive Big 8 commercial traders et al. continue to have an iron grip on their respective prices -- and that circumstance will continue until they either relinquish control voluntarily, are told to step aside...or get overrun. Of course closing the COMEX/LBMA would also get them out with their skins intact.

Considering the current state of affairs of the world as they stand today -- and the structural deficit in silver -- and now in platinum and palladium as well, the chance that these big bullion banks and commodity trading houses could get overrun at some point, is no longer zero -- and certainly within the realm of possibility if things go totally non-linear somewhere.

But...as Ted kept reminding us...if they do finally get overrun, it will be for the very first time...which obviously wasn't allowed to happen this past month, either.

The next Bank Participation Report is due out on Friday, October 10.

![]()

CRITICAL READS & VIDEOS

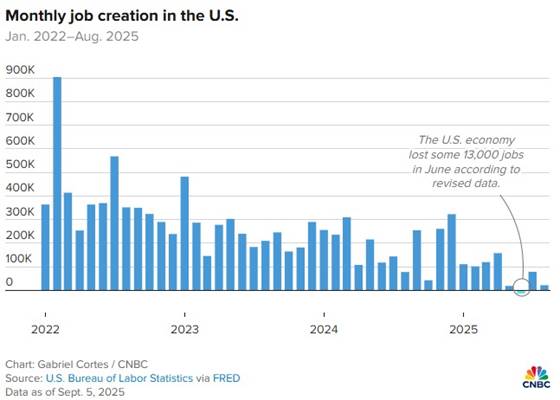

Payrolls rose 22,000 in August, less than expected in further sign of hiring slowdown

Job creation sputtered in August, adding to recent signs of labor market weakening and likely keeping the Federal Reserve on track for a widely anticipated interest rate cut later this month.

Non-farm payrolls increased by just 22,000 for the month, while the unemployment rate rose to 4.3%, according to a Bureau of Labor Statistics report Friday. Economists surveyed by Dow Jones had been looking for payrolls to rise by 75,000.

The report showed a marked slowdown from the July increase of 79,000, which was revised up by 6,000. Revisions also showed a net loss of 13,000 in June after the prior estimate was lowered by 27,000. Click to enlarge.

“The job market is stalling short of the runway,” said Daniel Zhao, chief economist at jobs site Glassdoor. “The labor market is losing lift, and August’s report, along with downward revisions, suggests we’re heading into turbulence without the soft landing achieved.”

Markets largely disregarded the report, with stocks up at the open and Treasury yields sharply lower. Traders in the futures markets raised the probability of a quarter percentage point Fed rate cut to 100% and went even further, pricing in a 12% probability of a half-point move, according to the CME Group’s FedWatch gauge.

This CNBC story showed up on their Internet site at 8:31 a.m. EDT on Friday morning -- and I thank Swedish reader Patrik Ekdahl for today's first story. Another link to it is here. The Zero Hedge spin on this is headlined "Putrid Payrolls: Job Growth Collapses to Just 22K, Unemployment Rate Rises to 4.3% Putting 50bps Rate Cut in Play" -- and linked here.

![]()

Demand for industrial space falls for the first time in 15 years

Five years ago, when the pandemic pushed e-commerce to new highs, the industrial warehouse space became the biggest commercial real estate play around. It began to slow in 2022, but now economic uncertainty brought on by constantly changing tariff policy and persistently high inflation is taking a greater toll on this previously hot real estate sector.

Just 27 million square feet of space was absorbed in the first half of this year, with demand falling by 11.3 million in the second quarter alone, the first quarterly drop since 2010, according to a report from NAIOP, a commercial real estate development association.

Since the uncertainty is likely to continue through the end of this year, NAIOP therefore projects that net absorption will be “nearly flat” over the second half of this year.

“Demand for industrial space is expected to recover somewhat after occupiers have time to adjust to a new tariff regime,” the report’s authors said.

“However, higher tariffs and slowing employment growth will likely result in slower demand growth than that experienced from 2020 to 2022 or in the six years that preceded the pandemic."

Another CNBC story from Patrik. This one put in an appearance on their website at 8:30 a.m. on Friday morning EDT -- and another link to it is here.

![]()

The train keeps rumbling and trundling down the tracks.

Out the window, the most exciting financial trend we’ve seen so far this year? Al Jazeera:

The gold market is booming as investors seek a safe haven for their investments amid global economic uncertainty. The price of gold has risen by nearly a third over the past year, surpassing $3,550 per ounce on Wednesday to hit an all-time high.

And the biggest worry? Bloomberg:

'Global Bond Sell-off Deepens with Longer Debt Leading Losses'

What are these news stories telling us? We don’t know for sure, but we think this train is headed for a place that begins with an ‘s.’

Tariffs are essentially a sales tax. And a sales tax — averaging maybe 15% — is going to reduce consumer purchasing power…and cut into sales and profits. That is, it will be downer.

Fewer goods and services will trade hands. GDP growth will slow. Sales and profits will fall. A real slowdown, in other words.

And look, we strain our eyes…we can now make out the first four letters of the sign ahead — s, t, a, and g…

This worthwhile and informative commentary from Bill showed up on his website at 9:27 a.m. EDT on Friday morning -- and I thank Roy Stephens for sending it our way. Another link to it is here.

![]()

The Law of Bubbles -- Doug Noland

An apt Friday evening headline from “The Times” (U.K.): “After a Very Brief Selling Frenzy, Bonds Are Back in Fashion.” What a difference a few trading sessions can make.

U.K. 30-year gilt yields jumped to 5.75% in Monday trading – the high back to June 9, 1998 – before reversing 24 bps lower to close the week to 5.51%. After jumping to 4.52% - the high since June 11, 2009 – French 30-year yields closed the week at 4.37%. Italy’s 30-year yields traded Wednesday to 4.68% - within two bps of a 30-month high - then closed at 4.51%. Japanese 30-year yields rose to a multi-decade high of 3.30% Wednesday (ended week 3.24%). Australia long yields trade up to 5.19% Wednesday, the highest since November 1, 2023 (ended week 5.08%).

Wild global bond volatility didn’t garner much attention here at home. Early in the week, it appeared global long-bond yields were breaking decisively to the upside. Even 30-year Treasury yields hit 5.0% early Wednesday morning, within only 11 bps of the October 2023 spike to the highest yield since July 2007. Long-bond yields ended the week down 17 bps to 4.76%. After trading to 4.30% early Wednesday, 10-year Treasury yields closed the week 15 bps lower at 4.07%.

Treasury and global yields reversed on Wednesday’s weaker-than-expected job openings (JOLTS) data. Buying only intensified on Friday’s weak (22k) August Non-Farm Payrolls report, surely fueled by a short squeeze and reversal of hedges. The rates market is now pricing 69 bps of cuts by year end, eight bps more on Friday’s session and 13 for the week.

The Fed is about to commence another round of rate cuts, with financial conditions even looser than when they initiated round one. Gold’s $139 weekly gain (4.0%) to a record $3,587 pushed y-t-d gains to 36.7%. Silver’s 3.2% rise boosted 2025 gains to 41.9%. Platinum’s 0.6% increase raised y-t-d gains to 52%. The S&P500 and NASDAQ Composite traded at record highs Friday.

Doug's worthwhile weekly commentary showed up on his website around midnight last night -- and another link to it is here.

![]()

Two Worthwhile and Important Video Interviews

1. Trump and the Constitution -- Colonel Douglas Macgregor

This interesting and worthwhile 29-minute video interview with the Colonel was hosted by Judge Andrew Napolitano very late on Thursday afternoon EDT -- and I didn't have space for it in my Friday missive...so here it is now. It comes to us courtesy of Guido Tricot as always -- and the link to it is here.

2. INTEL Roundtable w/Larry Johnson & Ray McGovern :: Weekly Wrap 5-September

This 31-minute video interview with former CIA analysts McGovern and Johnson was hosted by the Judge late on Friday afternoon EDT -- and it's certainly worth your while if you have the interest. I thank Guido for this one as well -- and the link to it is here.

![]()

Stablecoin group Tether holds talks to invest in gold miners

Tether, the biggest stablecoin company, has held talks about investing in gold mining, seeking to deploy its vast crypto profits into bullion.

The company has held discussions with mining and investment groups about investing in the entire gold supply chain, from mining and refining to trading and royalty companies, according to four people familiar with the recent talks.

While gold has been a physical store of value for thousands of years and bitcoin has only existed as a digital instrument since 2009, there is a growing affinity between some industry executives.

Tether chief executive Paolo Ardoino has likened gold to "natural bitcoin."

"I know people think that bitcoin is 'digital gold,'" he said in a speech in May. "I prefer to think in bitcoin terms -- I think gold is our source of nature." ...

The rest of this very interesting news item is hidden behind the paywall over at the ft.com Internet site. This story was posted on their website on Friday morning BST -- and I found it embedded in a GATA dispatch. Another link to it is here.

![]()

Silver price shock incoming as 'insatiable' physical demand drains supply -- insider

A silver price shock is coming. In this exclusive interview, former Chairman of The Silver Institute Phil Baker warns Kitco's Jeremy Szafron that "insatiable" physical demand is creating a historic supply deficit that could lead to a violent repricing of the metal. The former CEO of Hecla Mining reveals why the current silver rally is fundamentally different from the "fake-outs" that frustrated investors in 2011 and 2020. Baker provides an on-the-ground report from his recent trip to the Perth Mint, where he was told physical demand has "exploded". He also reveals a fascinating sociological shift: heirs are no longer selling their inherited silver, creating a "long-term generational sort of asset" that is permanently tightening the market. Why does he believe the silver price will go "significantly higher than $50" and that an "$80 silver" price is "certainly possible"? Watch now to find out.

This almost 29-minute kitco.com video interview with the former Chairman of The Silver Institute contains few surprises -- and doesn't tell us anything we don't already know. But coming from the likes of him, it's just another foreshock before the main event -- and I have more on this in The Wrap. I thank Tim Gorman for pointing it out -- and another link to it is here.

![]()

QUOTE of the DAY

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from the past' is one I've featured before...but certainly not this year. I consider it to be the greatest rock song to ever come out of Canada. With a strong rock synthesizer start to the song, followed by a steady build on the guitars, it peaked at #7 on the RPM singles chart in 1981 and #6 on the Billboard Top Rock Tracks chart in the U.S. Record World attributed the song's success to "Mike Reno's vocal plea, a guitar grind, and marvelous production." Yes, it's all of that, plus more -- and the link is here.

But it's the guitars that make this song. The bass cover to this is linked here -- and the absolutely awesome lead guitar cover to this is here...as he just slays it.

Today's classical blast from the past is Beethoven's Piano Concerto No. 5 in E-flat major, Op. 73 -- and is known as the Emperor Concerto in English-speaking countries. He composed it in 1809 under salary in Vienna, and he dedicated it to Archduke Rudolf, who was his patron, friend, and pupil. Its public premiere was on 28 November 1811 in Leipzig, with Friedrich Schneider as the soloist and Johann Philipp Christian Schulz conducting the Gewandhaus Orchestra. Beethoven, usually the soloist, could not perform due to declining hearing.

Beethoven felt the Napoleonic Wars reaching Vienna in early 1809 and completed writing the piano concerto in April while Vienna was under siege by Napoleon's armies. He wrote to his publisher in July 1809 that there was "nothing but drums, cannons, men, misery of all sorts" around him. To save his hearing, he fled to his brother's cellar and covered his ears with pillows. The work's heroic style reflects the war-ridden era in its military topics and heroic tone.

Romanian-born Alina Bercu is the featured soloist in this performance -- and is accompanied by the Orchestra of the University of Music Franz Liszt Weimar in this November 16, 2017 live performance. It's wonderful -- and the link is here.

![]()

Despite the ugly jobs number -- and the big swoon in the dollar index, the collusive commercial shorts of whatever stripe weren't going to allow gold to close above $3,600 spot...or silver over $41 sport...although both are well above those figures in their respective current front months...December for both.

It dawned on my later on Friday, that the reason that both gold and silver were engineered lower in Globex trading on Thursday afternoon in New York ...plus more in early Globex trading in the Far East on Friday, was that 'da boyz' knew what the jobs report contained -- and they wanted both metals to start from a lower price base once the report came out. In that regard, they were only partially successful.

Gold is now a bit further into overbought territory on its RSI trace -- and at a new record high close. Of course silver is being held well below its old nominal high-- and just below overbought on its RSI trace.

Both platinum and palladium were closed lower for the second straight day. The former is still above its 50-day moving average by a handful of dollars -- and the latter is now mired in no-man's land between that moving average and its 200-day.

Copper was closed down a further 3 cents at $4.47/pound...its third straight 'losing' session -- and is now 15 cents below any moving average that matters.

Natural gas [chart included] made its second attempt in as many days to break above its 50-day moving average, but was turned aside once again -- and closed down a nickel at $3.02/1,000 cubic feet. WTIC continues to plunge further below its 50-day...as it was closed down a further $1.51 at $61.97/barrel...most likely on this news.

Here are the 6-month charts for the Big 6+1 commodities...courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

The big news yesterday was buried deep out of sight in the latest Bank Participation Report, where the 5 U.S. banks that are currently net short silver, cut their short positions by almost 50 percent during August. As of Tuesday's cut-off, they were only short 13,779 COMEX contracts between them...only around 2,755 contracts each, if divided up equally. However, that wouldn't be the case in reality.

This is their third lowest short position that I have written records for...going all the way back to July 2014. As you may recall, I mentioned on numerous occasions in July and August about all the hinky stuff going on in silver open interest that I'd never seen before...both in the daily numbers -- and the odd time in the weekly Commitment of Traders Report. These strange goings-on were obviously their machinations to cover their short positions -- and to get other traders in the commercial category to go short in their stead...a good chunk of which ended up with the non U.S. banks -- and Ted's raptors.

Looking at yesterday's COT Report with fresh eyes -- and armed with this new information, which I didn't have when I wrote up my COT commentary...as I do the Bank Participation Report last, reveals some shocking new truths.

Of the Big 4 shorts in silver, only one of them might be a U.S. bank -- and they would most likely be the smallest of the Big 4. It's entirely within the realm of possibility that they aren't in that category at all...but the largest members of the Big '5 through 8' shorts. The other four U.S. banks aren't members of the Big 8 at all anymore.

This leaves the non-U.S. banks, hedge funds and most likely some commodity trading houses as the new Big 7 of the Big 8 shorts in the COMEX futures market. This may also explains why Ted Butler's raptors...the small commercial traders other than the Big 8 shorts...went from a long position of 5,016 contracts back in the 08 August COT Report...to a net short position of 4,991 contracts in yesterday's report...a swing of 10,007 COMEX contracts... the long sides of those trades which ended up with the five U.S. bullion banks.

You may remember several weeks back where I mentioned in a prior August COT Report that there was one trade in the commercial category that looked like it had been managed between one group of commercial traders and another. These new findings in yesterday's Bank Participation Report goes a long ways to explain that -- and puts 'paid' to it as far as I'm concerned.

The non-U.S. banks increased their net short position in silver by 3,819 COMEX contracts during August -- and Ted's raptors provided 10,007 long contracts -- and the five U.S. bullion banks were gobbling up all long contracts being sold -- and taking the long side of any short sale.

I can't shake the feeling that this only came about by pure collusion, not only by a small group of traders within the collusive commercial category itself...but had help from the CME Group, which they must have been involved in order to pull this off.

And as incandescent as this makes the wildly bullish set-up in silver...I'm going to spend a moment on the U.S. bullion bank's No. 2 problem child... platinum. Back in October of last year, five U.S. banks...most certainly the same five U.S. banks short silver...were net short 20,842 COMEX platinum contracts -- and of yesterday's Bank Participation Report, had that whittled down to only 4,887 contracts...their smallest short position since October 2018.

I suspect that the very punk and counterintuitive performance since Tuesday's cut-off has been the U.S. banks attempting to rid themselves of the last of their short position in that precious metal. Most of their short position now resides with the non-U.S. banks, hedge funds and commodity trading houses...like it is in palladium.

Changing the subject -- and although I haven't had time to watch it, that interview in the Critical Reads section with former Hecla Mining CEO -- and former Chairman of The Silver Institute, Phil Baker was a shocker, if the write-up that accompanied it lived up to its advance billing. He -- and by extension The Silver Institute, is now predicting in the public domain what Ted had been going on about for almost 40 years...that silver's price is about to be adjusted upwards in an explosive move.

Coming from him, a card-carrying member of the deep state/swamp creature if there ever was one, this mea culpa at this stage of the game, had to have come with the approval of the Silver Institute itself, as they didn't want to be caught out when this event transpired.

Add that into the mix of the that shocking implosion in the U.S. bullion banks' short position in silver [and platinum]...along with the stealth accumulation of silver and silver equities over the last little while...the stage is now set for that event. Only the timing is uncertain...but as I've been saying for decades, this won't happen in a news vacuum.

When this is finally allowed to transpire, what Ted spoke of more than two decades ago in his essay..."Take it to the Limit" -- and his essay of two years ago headlined "The Bonfire of the Silver Shorts"...will go live.

However, another massive but brief spike lower/bear raid by 'da boyz' in advance of that event, cannot be ruled out. It will most likely provide the last possible entry point at the current silver price...one never to be seen again.

For all of the above reasons...which are more than enough in and of themselves...plus a whole a whole host of others than I didn't have the time to address in The Wrap today, I'm still "all in" -- and will remain so to whatever end.

I'm done for the day -- and the week -- and I'll see you here on Tuesday.

Ed