The gold price rallied a few dollars during the first two hours of Globex trading on Thursday evening in New York -- and was then sold/engineered lower until around 11:35 a.m. China Standard Time on their Friday morning. It rallied from there at an ever-decreasing rate until it took off higher anew starting at the COMEX open in New York. That rally ran into 'something' at 9:45 a.m. EDT -- and again for the final time at noon. From that juncture it was forced to wander unevenly sideways until the market closed at 5:00 p.m. EDT.

The low and high ticks in gold were reported as $3,861.10 and $3,916.80 in the December contract...an intraday move of $55.70 the ounce. The October/ December price spread differential in gold at the close in New York yesterday was $28.10...December/February26 was $31.20...February/April26 was $27.50 -- and April/June26 was also $27.50 an ounce.

Gold was closed in New York on Friday afternoon at $3,885.00 spot...up $29.50 on the day... exactly 5 bucks off its Kitco-recorded high tick -- and $47.60 off its low. Net volume was pretty heavy at a bit under 206,500 contracts -- and there were a bit over 12,000 contracts worth of roll-over/ switch volume on top of that.

I saw that 392 gold, plus 53 silver contracts were traded in October yesterday, but it remains to be see just how much of the shows up in tonight's Daily Delivery and Preliminary Report data further down in today's column.

![]()

Silver's price path was very similar to gold's, but its somewhat uneven rally off its 11:35 a.m. CST low tick, was far more robust -- and 'da boyz' showed up in it when it began to show signs of going 'no ask' at 11:30 a.m. in COMEX trading in New York. Thirty minutes later they began to lean on the price -- and engineered it lower until 1:55 p.m. in after-hours trading. Its ensuing rally attempt ran into 'grief' around 2:45 p.m. -- and it was then sold one quiet step lower until the market closed at 5:00 p.m. EDT.

The low and high ticks in silver were recorded by the CME Group as $46.55 and $48.325 in the December contract...an intraday move of $1.775 an ounce. The December/March26 price spread differential in silver at the close in New York yesterday was a hefty 56.8 cents...March/ May26 was 35.9 cents -- and May/July26 was 34.8 cents an ounce.

Silver was closed on Friday afternoon in New York at $47.915 spot...up 99 cents from Thursday -- and a hefty 37.5 cents off its Kitco-recorded high tick. Net volume was pretty heavy at a bit under 87,000 contracts -- and there were around 8,200 contracts worth of roll-over/switch volume in this precious metal.

![]()

Platinum edged very quietly lower at an ever-increasing rate until around 11:30 a.m. China Standard Time in Globex trading on their Friday morning -- and its very broad, quiet and somewhat uneven rally ran into 'something' at 9:40 a.m. in COMEX trading in New York -- and then again for the last time a very few minutes before 12 o'clock noon EDT...just like what happened in gold. It was sold one step lower from there until 2 p.m. in after-hours trading -- and then took one quiet step higher until the market closed at 5:00 p.m. EDT. Platinum was closed at $1,604 spot...up 31 dollars on the day -- and 9 bucks off its Kitco-recorded high tick.

![]()

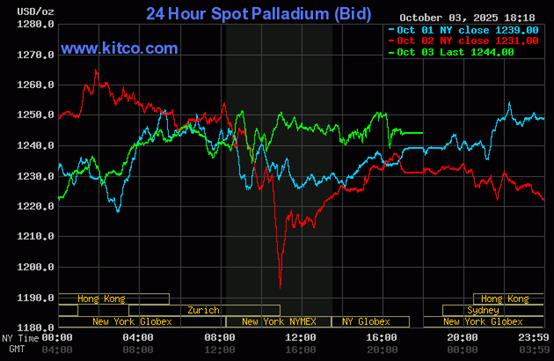

Palladium had a broad, quiet and somewhat uneven and ascending down/up move centered around noon CST in Globex trading on their Friday -- and ending around 12:45 p.m. in Zurich. From that juncture it was forced to chop very unevenly sideways until trading ended at 5:00 p.m. EDT. Palladium was closed at $1,244 sport...up 13 dollars from Thursday -- and 9 bucks off its Kitco-recorded high tick.

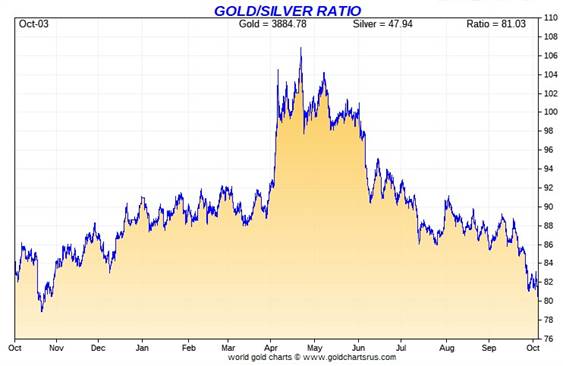

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 81.1 to 1 on Friday...compared to 82.2 to 1 on Thursday.

Here's Nick's 1-year Gold/Silver Ratio chart, updated with this past week's data. Click to enlarge.

![]()

The dollar index closed very late on Thursday afternoon in New York at 97.85 -- and then opened unchanged once trading commenced at 7:34 p.m. EDT on Thursday evening...which was 7:34 a.m. China Standard Time on their Friday morning. From that juncture in wandered/ chopped unevenly higher until a couple of minutes after 2 p.m. CST on their Friday afternoon. It then proceeded to wander/chop broadly lower until its spike low tick was set at 10:07 a.m. in New York. Its very uneven rally attempt from there topped out exactly four hours later...was sold a bit lower until around 4:12 p.m. -- and edged a tad higher until the market closed at 5:00 p.m. EDT.

The dollar index finished the Friday trading session in New York at 97.71 ...down 14 basis points on the day.

Here's the DXY chart for Friday...thanks to marketwatch.com as always. Click to enlarge.

![]()

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...97.70...and the close on DXY chart above, was 1 basis point below that. Click to enlarge.

![]()

Like it was on Thursday, the action in the currencies was an inconsequential side show -- and totally divorced from what was happening in the precious metals.

U.S. 10-year Treasury: 4.1190%...up 0.0310/(+0.7583%)...as of the 1:59:53 p.m. CDT close

The yield on the ten-year headed higher as soon as COMEX trading began in New York -- and the Fed was forced to step in at 10:33 a.m. EDT. Its yield never got higher than that for the rest of the day.

For the week, the 10-year yield was down 6.80 basis points...thanks to the Fed.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

As I continue to point out in this spot every week, the 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023 -- and it's more than obvious from the above chart that it will be kept as low as possible, for as long as possible.

![]()

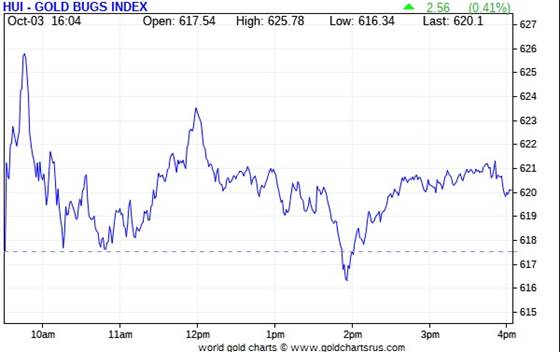

Not surprisingly, the gold shares jumped higher at the 9:30 opens of the equity markets in New York on Friday morning, but like we've been witness to on several occasions this week, a willing seller appeared at 9:45 a.m. -- and sold them back to unchanged by around 10:50 a.m. Their ensuing rally attempts ran into more selling at precisely 12 o'clock -- and they were sold down into negative territory by a few minutes before 2 p.m. They then struggled a bit higher at an ever-decreasing rate until trading ended at 4:00 p.m. EDT. The HUI closed higher by only 0.41 percent.

![]()

Despite the fact that silver vastly outperformed gold, the price action in the silver equities were managed in an identical fashion as the gold shares -- and Nick Laird's Silver Sentiment Index closed up only 0.66 percent. Click to enlarge.

![]()

The two stars were Silvercorp Metals and Avino Silver & Gold Mines, closing higher by 5.58 and 4.81 percent respectively. It's hard to believe that some of these silver companies actually closed down on day, but some did ...four in total...with the biggest underperformer being Hecla Mining, as it closed down 1.33 percent.

Once again it's my firm belief that someone is intervening in the shares to prevent them from fully reflecting the rise in silver and gold prices...as no for-profit sellers, ever sell this way...EVER!

Once again, I didn't see any news yesterday on any of the silver stocks that comprise the above Silver Sentiment Index.

The silver price premium in Shanghai over the U.S. price on Friday remained at an irrelevant 1.95 percent...because China is closed until the 9th.

The reddit.com/Wallstreetsilver website, now under 'new' and somewhat improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

Here are the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver Sentiment Index.

Here's the weekly chart -- and the underperformance of the precious metal equities... especially the silver stocks...is the standout feature of this chart -- and is even more pronounced on the month-to-date chart below. Click to enlarge.

Here's the month-to-date chart...for Wednesday, Thursday and Friday -- and it's ugly, as 'da boyz' were active in everything...the metals -- and the stocks. The first three trading session of October, really skewed the weekly chart above. This is a perversion. Click to enlarge.

Here's the year-to-date chart -- and although impressive on its face, the equities still lag the metals...especially the silver stocks. Silver has now surpassed gold in year-to-date gains -- and by a very wide margin...well over 16 percentage points. But it's only a matter of time before the silver equities reflect that...notwithstanding what 'da boyz' were up to this past week or so. Click to enlarge.

Of course -- and as I also point out in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting at a new all-time high of 'whatever' dollars an ounce, like gold is sitting at another new all time high price of $3,885/ounce...it's a given that the silver equities would be outperforming their golden cousins... both on a relative and absolute basis -- and by an absolute country mile...or two. That day, as I also keep mentioning, lies in our future -- and sometime very soon, I hope.

![]()

The Daily Delivery Report for Day 5 of October deliveries showed that 185 gold -- and 55 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the three short/issuers were Canada's Scotiabank/Scotia Capital, Wells Fargo Securities -- and ADM...issuing 121, 37 and 27 contracts respectively...ADM from their client account. JPMorgan was the sole long/ stopper for its client account.

In silver, the four short/issuers were Deutsche Bank, ADM, Wells Fargo Securities and StoneX Financial, issuing 21, 16, 10 and 8 contracts respectively...Deutsche Bank and Wells Fargo from their respective house accounts. The two long/ stoppers were JPMorgan and the CME Group, picking up 45 and 10 contracts...the CME Group for their own account.

They immediately reissued theirs as 5x10=50 of those one-thousand ounce good delivery bar micro silver futures contracts. The usual two long/stoppers for those were Advantage and ADM, picking up 37 and 13 contracts for their respective client accounts.

In platinum and palladium there were 87 and 43 contracts issued and stopped respectively.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date -- and only five days worth so far, there have been 30,403 gold contracts issued/reissued and stopped in October so far...which is a "pseudo" scheduled delivery month for gold, if you remember. In silver it's 2,874 COMEX contracts. In platinum and palladium, it's 4,085 and 184 contracts issued and stopped respectively.

The CME Preliminary Report for the Thursday trading session, showed that gold open interest in October fell by 2,258 COMEX contracts, leaving 643 still around...minus the 185 contracts out for delivery on Tuesday as mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 2,570 gold contracts were actually posted for delivery on Monday, so that means that 2,570-2,258=312 more gold contracts were added to October deliveries.

Silver o.i. in October dropped by 309 contracts, leaving 156 still open... minus the 55 contracts out for delivery on Tuesday as per the above Daily Delivery Report. Thursday's Daily Delivery Report showed that 349 silver contracts were actually posted for delivery on Monday, so that means that 349-309=40 more silver contracts were added to October deliveries.

Total gold open interest in the Preliminary Report on Friday night rose by an eye-watering 19,469 COMEX contracts-- and total silver o.i. increased as well, but only by 1,871 contracts. I'm certainly hoping that the big increase in gold open interest yesterday will have mostly disappeared in the final report on Monday.

[I checked the final total open interest numbers for the Thursday trading session -- and it showed a big drop in total gold open interest...from +82 contracts, down to -6,273 COMEX contracts. I was hoping for a far larger decline than that, but it is what it is. There was a small decrease in total silver o.i. on Thursday...from +631 contracts, down to +431 contracts. The fact that total silver open interest increased at all on its $2+ price smash on Thursday is still something I'm trying to wrap my head around...as it made no sense.]

Gold open interest in November in the final report for Thursday -- and posted on the CME's website on Friday morning, rose by 55 contracts, leaving 4,503 still open. The final silver o.i. number for November on Thursday jumped by 208 contracts, leaving 2,553 COMEX contracts still open.

![]()

There was a further withdrawal from GLD yesterday, as an additional 27,612 troy ounces of gold were removed...however, there were 15,840 troy ounces of gold added to GLDM. And after a monster withdrawal on Thursday, there was a withdrawal of about an equal amount from SLV on Friday, as an authorized participant or two, took out a further 7,669,406 troy ounces of silver.

Since the start of October on Wednesday, there have been 16,562,645 troy ounces of silver withdrawn from SLV...a staggering amount. During that time period, silver is up about $1.50 an ounce...so what those withdrawals were about, is impossible to know. But they're certainly counterintuitive.

The SLV borrow rate started the Friday session at 2.35% -- and finished it at 2.54%...with zero shares available to short by the end of the day. The GLD borrow rate began the day at 0.45% -- and closed at 0.55%... with 4.0 million shares available.

In other gold and silver ETFs and mutual funds on Earth on Friday ...net of any changes in COMEX, GLD, GLDM and SLV activity, there were a net 372,289 troy ounces of gold added...but a net 39,056 troy ounces of silver removed -- and all because of the 662,474 troy ounces that left iShares/SSLN.

And still nothing from the U.S. Mint.

![]()

There was a bit of activity in gold over at the COMEX-approved depositories on Thursday. There were 22,570.002 troy ounces/702 kilobars received over at Loomis International -- and 17,608 troy ounces were shipped out...with the largest 'out' amount being the 16,000 troy ounces that departed Asahi.

There was some paper activity -- and that happened over at Asahi as well. There were 62,640 troy ounces transferred from the Registered category and back into Eligible.

The link to Thursday's COMEX gold activity is here.

There was more hefty activity in silver, as 1,732,674 troy ounces were reported received -- and 334,033 troy ounces were shipped out.

The three biggest 'in' amounts were the 599,682 troy ounces/one truckload that arrived at Loomis International...followed by the one truckload/598,249 troy ounces that showed up at Asahi -- and another 533,710 troy ounces appeared over at CNT.

The two 'out' amounts were the 200,133 and 133,900 troy ounces that departed CNT and StoneX respectively.

There was more monster paper action, as 3,098,293 troy ounces were transferred from the Registered category and back in Eligible -- and 686,235 troy ounces were transferred from the Eligible category and into Registered. That latter amount made that trip over at CNT. The largest transfer from the Registered category and back into Eligible were the 2,554,446 troy ounces transferred over at Brink's, Inc.

The link to all of Thursday's very impressive COMEX silver action is here.

With China closed until October 9, the Shanghai Futures and Shanghai Gold Exchanges had no reports on their silver inventories.

![]()

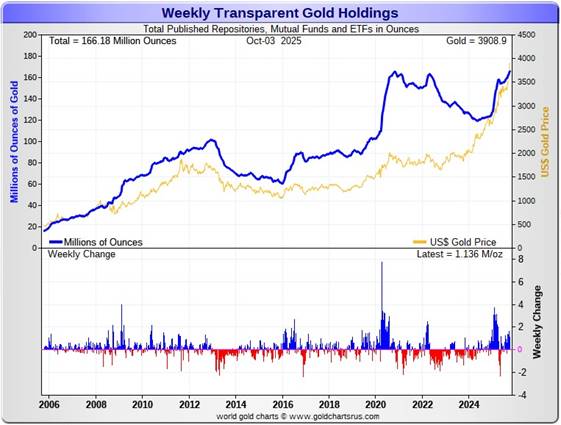

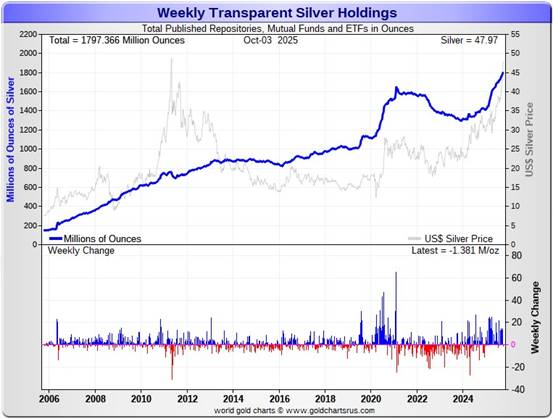

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the business week just past, there were a net 1.136 million troy ounces of gold added -- but a net 1.381 million troy ounces of silver were removed -- and the sole reason for that is stated in today's headline ...the 16.562 million troy ounces withdrawn from SLV over the last three business days.

According to Nick Laird's data on his website, a net 3.912 million troy ounces of gold were added to all the world's known depositories, mutual funds and ETFs during the last four weeks. The three largest 'in' amounts were the 1.119 million into GLD, followed by the net 1.117 million troy ounces into the COMEX -- and the 734,000 troy ounces into iShares IAU. There were only a tiny handful of net withdrawals, none of which are worthy of mention.

As I continue to point out in this space, despite the fact that we're now just under $3,900 in gold -- and at a another new record high, the amount of gold held by all the world's mutual funds, depositories and ETFs still remains a tiny bit below its all-time high set back in late 2020...as per the chart above.

However, as I continue to point out, it should be noted that despite the fact that silver is still a bit below its previous $50 nominal high of April 2011...the amount of silver held in all these depositories, ETFs and mutual funds is now a very noticeable amount above its old all-time high inventory level of January 2021.

Except for the odd week here and there, there have been 35 almost consecutive weeks/8.5 months of net silver inflows into all the world's depositories, ETFs and mutual funds -- and that silver taken out of SLV in the last three days didn't disappear off the face of the earth... somebody owns it. As I keep saying in this space, there are obviously some deep-pocket silver stackers out there that know what we know -- and probably know more than we know as well.

A net 36.593 million troy ounces of silver were added during that same 4-week time period... with the largest net 'in' amount being the 12.975 million troy ounces added to the COMEX. That's followed by the more than ten Indian silver ETFs...with 6.133 million troy ounces added -- along with the 3.962 million oz. into Aberdeen. Next was Sprott's PSLV, adding 2.904 million troy ounces -- and the 2.843 million oz. into ZKB. The list goes on and on...and on... There were no withdrawals worthy of the name.

Retail sales have picked up noticeably -- and dealer buy-backs have waned considerably as well. I'm certainly glad to see it, but this is just jacks for openers. The big institutional investors continue making their presence felt in the various ETFs and mutual funds...silver in particular, as you can tell. Gold deposits have picked up as well over the last few weeks.

At some point there will be ever larger quantities of silver and gold required by all the rest of these ETFs and mutual funds once serious institutional buying really kicks in -- and that's in our face now.

However, the really big buying lies ahead of us when the silver price is finally allowed to rise substantially, which I'm sure is something that the powers-that-be in the silver world are more than aware of.

It now appears to be obvious that JPMorgan has parted with virtually all of the one billion plus troy ounces that they'd accumulated since the drive-by shooting that commenced at the Globex open at 6:00 p.m. EDT on Sunday, April 30, 2011.

It's pretty much a given that most of the silver flown into the COMEX from London so far this year came from their stash at the LBMA. I'm sure they've been supplying the silver that's flowing into the rest of world's ETFs and mutual funds too...including what's been going into SLV, Aberdeen, and Sprott's PSLV -- plus all the rest.

Little has changed from last week, as the physical demand in silver at the wholesale level continues very strong -- and COMEX silver deliveries have been huge all year...including the current delivery month...October...where 14.37 million troy ounces have been issued and stopped so far. The amount of silver being physically moved, withdrawn, or changing ownership remains very high, with the most notable being the deposits and withdrawals at SLV this past week.

This demand will continue until available supplies are depleted...which will most likely be the moment that JPMorgan & Friends stop providing silver to feed this deepening structural deficit, now well into its fifth year according to the ongoing reports from The Silver Institute.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 200.0 million troy ounces...up about 700,000 troy ounces from last week -- and a great distance behind the COMEX, the largest silver depository, where there are 531.9 million troy ounces being held...up a net 1.6 million troy ounces this past week...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 107.5 million troy ounce mark...quite a bit different than the 210.6 million they indicate they have...unchanged over the last two weeks.

PSLV remains a very long way behind SLV as well -- as they are now the second largest silver depository after the COMEX, with 487.7 million troy ounces as of Friday's close...down a net 6.2 million ounces from last week. [They added 10.393 million troy ounces of silver on Monday and Tuesday of this past week...before the big withdrawals on Wednesday, Thursday and Friday.]

The latest short report [for positions held at the close of business on Monday, September 15] showed that the short position in SLV exploded higher by 67.22%...from the 34.83 million shares sold short in the prior report...up to 58.25 million shares in this latest short report that came out ten days ago now...a bit more than 10 percent of total SLV shares outstanding. This amount is grotesque, obscene -- and fraudulent beyond all description...as there is no physical silver backing any of it as the SLV prospectus requires.

BlackRock issued a warning five or so years ago to all those short SLV that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it.

The next short report...for positions held at the close of trading on Tuesday, September 30 will be posted on The Wall Street Journal's website on Thursday evening EDT on October 9.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well.

The latest OCC Report for Q2/2025 came out ten days ago -- and it showed that the precious metal derivatives held by the four largest U.S. banks only increased by $25.8 billion/4.89% from Q1/2025...which is nothing much at all -- and that's despite the fact that precious metal prices rose fairly substantially during that time period.

JPMorgan's precious metals derivatives rose from $323.5 billion, up to $358.5 billion in Q2/2025 -- and Citigroup's also rose, but not by much, from $142.8 billion...up to $150.7 billion. BofA's fell from $61.7 billion, down to 44.7 billion -- and the derivatives position held by Goldman Sachs is a piddling and immaterial $219 million -- down from the $269 million held in Q1/2025.

But with JPMorgan holding 64.7% of all the precious metals derivatives... Citibank holding 27.2% -- and Bank of America about 8% of the total of the four reporting banks, it's only JPMorgan and Citigroup that matter.

And as I keep pointing out in this spot every weekend, the OCC indicator is flawed for two very important reasons, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others... that are card-carrying members of the Big 8 shorts. Now the list is down to just four banks...so a lot of data is hidden...which is certainly the reason why the list was shortened. On top of that, the list doesn't include the non-U.S. banks that are members of the Big 8 shorts: British, French, German, Canadian -- and Australian.

Because of the shut-down of the U.S. government, there was no updated Commitment of Traders data on the CFTC's website yesterday.

![]()

CRITICAL READS

Who Needs the BLS: U.S. Added 60,000 Jobs in September, Best Month of 2025

Due to the ongoing government shutdown - now in its third day - the BLS did not release the September jobs report this morning forcing traders and the Fed to "fly blind." And with ADP (whose track record has been just as woeful as that of the BLS) reporting earlier this week that some 32,000 jobs had been lost in September, putting markets and economists on edge and the U.S. economy on the verge of a labor recession, the lack of data could not have come at a worse time. Luckily, private sector alternatives to the BLS do exist and, in many cases, are far more accurate and certainly less politicized.

One such source was the Institute for Supply management which found that both Manufacturing and Service Jobs posted a modest rebound from multi-month lows, dashing fears of a worst case outcome.

But while the ISM survey is useful, it is a diffusion index, and does not provide an absolute number for benchmarking purposes, something the market's algos prefer. So one has to look elsewhere for more apples to apples comparisons.

Some examples of such sources include Census Business Pulse, Challenger, and Homebase, but one name that has received some prominence in recent months is Revelio Labs.

While we wouldn't ascribe an outsized influence to any of these third-party data sets as they all have their strengths and weaknesses and have to be seen in the totality context of all reports, the latest Revelio number is very notable as it suggests that the labor picture is nowhere near as bad as ADP indicated. In fact, in September, the Revelio Labs data set showed the best monthly increase in jobs in 2025!

Another number that should be taken with a goodly amount of salt, dear reader. This article showed up on the Zero Hedge website at 12:59 p.m. EDT on Friday afternoon -- and another link to it is here.

![]()

"Huge Red Flag" - Chanos Joins Growing Crowd Questioning Subprime Credit in "The Golden Age of Fraud"

In a 2020 lunch with the FT interview, Jim Chanos said financial markets were in “the golden age of fraud”.

On Thursday he said this phenomenon had “done nothing but gallop even higher” since he made the remark.

And now, as we have been highlighting recently, the dominoes may have started falling...

Beneath the surface of what’s been a remarkably resilient U.S. economy, a series of small shocks in the world of consumer credit have combined to rock companies that service financially-vulnerable Americans, raising major questions about the true strength of the supposedly omniscient consumer's health.

Following the collapse of Tricolor Holdings (a subprime auto lender), and weak second-quarter results from CarMax; we have seen car parts supplier First Brands Group wrongfooting investors further with payments company Klarna and buy-now, pay-later firm Sezzle also suffering declines alongside the 'Alts' market and private credit...

[S]everal large banks have also been caught up in the collapse, including JPMorgan Chase and Fifth Third, which are exposed to losses on hundreds of millions of dollars' worth of auto loans.

A second investor who has since sold their position in packaged-up Tricolor loans said they had no idea how potential financial irregularities went unnoticed by JPMorgan Chase, one of the banks that underwrote debt offerings.

“That’s the shocking part of it,” the investor said. “JPMorgan is one of the most sophisticated lenders in the entire world. How the hell could they have missed this?”

JPMorgan declined to comment.

This 2-chart news item appeared on the Zero Hedge website at 2:40 p.m. EDT on Friday afternoon -- and another link to it is here.

![]()

A Feature, Not a Bug -- Doug Noland

I point to the June 2007 implosion of two Bear Stearns funds - the High-Grade Structured Credit Fund and the Enhanced Leveraged Fund - as a key Bubble-piercing catalyst. These funds employed sophisticated CDOs, derivatives, and heavy leverage - an aggressive “cutting edge” strategy that beamed brilliance - until it abruptly blew apart. As is commonplace during “Terminal Phases,” “sophisticated” strategies that incorporate derivatives and aggressive leveraging rest on the specious assumption of liquid and continuous markets.

The Bear Stearns fund implosion essentially ended the subprime mortgage/ derivatives Bubble, crucial Wall Street alchemy that had transformed essentially unlimited high-risk mortgages into (mostly) perceived (relatively) safe and liquid money-like instruments. The marginal homebuyer lost access to the mortgage marketplace, leaving inflated home prices and throngs of over-levered speculators no place to go but down – a cycle’s worth of masked fraud no place but to be exposed.

Crisis at the “periphery” unleashed contagion that would be revealed as deeply systemic months later. Importantly, the Fed would slash rates from 5.25% to 2.00% between September 2007 and April 2008. This extended the boom in AAA GSE-backed MBS, which I have argued only exacerbated “Terminal Phase Excess,” deepening financial and economic crises.

The ongoing global government finance Bubble so dwarfs mortgage finance Bubble excess. The amount of debt, speculative leverage, derivatives, and economic maladjustment is so far beyond anything previously experienced.

Today’s backdrop is fraught with monumental excess, along with important developing cracks.

Doug's Saturday commentary is always worth reading -- and this iteration appeared on this website around midnight last night. Another link to it is here.

![]()

Hungary's Orbán From Copenhagen Summit: "The E.U. Has Decided to Go to War"

Hungarian Prime Minister Viktor Orbán is newly warning that E.U. leaders are preparing for war with Russia, soon after he participated in the European Political Community meeting in Copenhagen.

He has denounced this as "horrifying" that "the E.U. has decided to go to war" and that at Wednesday's informal E.U. summit, leaders pushed a war strategy on how to defeat the Russians.

This reportedly features plans for a 'drone shield' to counter Russian incursions into member states’ air spaces, as well as long-planned efforts to confiscate seized Russian assets held in Europe. Conformity is being demanded of all member states.

"The pressure is great. So I will suggest to the Fidesz presidency that we start a signature campaign in Hungary against the E.U.'s war plans. Because we need all our strength to stay out of this war," Orbán said.

This news item was posted on the youtube.com Internet site at 4:15 a.m. on Friday morning EDT -- and another link to it is here.

![]()

Two worthwhile and informative video interviews

1. INTEL Roundtable w/Larry Johnson & Ray McGovern -- Weekly Wrap: Friday 03 October

This almost 34-minute video interview with McGovern and Johnson was hosted by Judge Andrew Napolitano late on Friday afternoon EDT -- and is certainly worth your while if you have the interest. I thank Guido Tricot for sending it our way -- and the link to it is here.

2. Europe Prepares the Public for War with Russia -- Patrik Baab

This very worthwhile 40-minute video interview with German journalist and best-selling author Parik Baab was hosted by Professor Glenn Diesen on Monday. Baab argues that the European leaders have painted themselves into a corner and increasingly see war as the only path forward.

The further along one gets into this interview, the more intriguing it gets. It's definitely worth your time if you have the interest -- and I thank Guido for this one as well. For length and content reasons I though it best to wait until Saturday's column to post it. It's already had 250K views -- and the link to it is here.

![]()

Morgan Stanley displaces bonds for gold

Morgan Stanley just blinked. After decades of worshiping at the altar of 60/40 (stocks/bonds), they shifted to 60/20/20 (stocks/bonds/gold). Gold now has a real seat at the table. Nobody likes to go first -- not in markets, not in start-ups, not in fashion. But once the ice breaks, the floodgates can open.

And MS isn’t fringe. They’re blue-chip. With a global reach and balance sheet that commands attention.

This interesting and worthwhile commentary from the chartsandparts. substack.com Internet site on Friday, was something I found in a GATA dispatch. Another link to it is here.

![]()

Gold Stocks Trounce AI-Led Chip Rally With 135% Gain in 2025

For all the hype over artificial intelligence and the surge in chip stocks this year, gold miners have actually been the better buy.

A gauge of the world’s gold equities from MSCI Inc. has soared about 135% this year, tracking gains in the precious metal. It’s on course for its greatest-ever outperformance versus the index compiler’s measure of major global semiconductor firms, which is up 40%.

The surprisingly large gap underscores a key dynamic in this year’s global markets: Even as a sense of FOMO drives investors to chase gains in anything related to AI, they are also lured by the relentless rally in gold as central banks around the world accumulate the metal.

“Gold and gold miners are one of my most bullish medium thematic calls,” said Anna Wu, a cross-asset investment strategist at Van Eck Associates Corp. in Sydney. Gold has safe haven appeal, “while gold miners are also set to benefit from margin expansion and valuation re-rating.”

Of course the silver shares are up the same amount, but that's not mentioned here. This Bloomberg story was picked up by yahoo.com -- and posted on their Internet site at 6:41 a.m. EDT on Friday morning -- and I found it on the gata.org website. Another link to it is here.

![]()

UBS raises gold, silver price forecasts again

UBS has raised its gold and silver price forecasts again, flagging strong momentum from investor demand, macroeconomic uncertainty, and persistent fiscal and geopolitical pressures.

The bank now expects gold to reach $4,200 an ounce across all time frames, up from its prior view of $3,800 by end-2025 and $3,900 by mid-2026.

Silver forecasts were lifted to $52 and $55 an ounce, compared with previous targets of $44 and $47.

UBS strategists said the revisions reflect expectations of stronger central bank and exchange-traded fund (ETF) demand, alongside ongoing support from declining real rates and fiscal imbalances.

The strategists also pointed to silver’s “greater room to overshoot,” given its higher volatility, adding that their forecasts remain skewed to the upside.

Both metals have surged this year, with gold hitting record highs in real and nominal terms and silver reaching levels last seen in 2011.

This precious metals-related story showed up on the investing.com Internet site on Friday -- and I thank Tim Gorman for pointing it out. Another link to it is here.

![]()

Perth Mint’s Gold Sales Rose In September, Silver Shone Even Brighter

September saw a rebound in gold and silver product sales for Perth Mint, driven by the popular Lunar Series coins and increased U.S. demand, even as annual gold sales lagged behind last year's highs.

Perth Mint’s gold sales jumped 21% last month, with silver soaring even higher by 36%—fueled by popular new coin releases and growing interest from U.S. buyers.

September handed Perth Mint a welcome boost, with gold sales reaching 36,595 ounces and silver product sales hitting 578,588 ounces, their highest since April. The standout performer was the Australian Lunar Series Year of the Horse coins, which drew strong attention from collectors and U.S. investors alike. While both gold and silver posted solid monthly gains, gold sales remained 31% below last year’s levels. These upticks mirrored global optimism—spot gold prices soared almost 12% last month, their best showing since 2011, as investors bet on U.S. interest rate cuts and reacted to persistent geopolitical worries. Silver also had a strong run, climbing over 17% in price. As the processor of about 75% of Australia’s newly mined gold, Perth Mint’s activity remains a bellwether for global precious metals demand, even as volumes ebb and flow.

This news story put in an appearance on the finimize.com Internet site on Friday -- and I found it on Sharps Pixley. Another link to it is here.

![]()

Hidden beneath the turquoise waters off a stretch of Florida known as the “Treasure Coast,” a team of divers from a shipwreck salvage company have uncovered exactly that — a load of long-lost Spanish treasure they estimate is worth $1 million.

More than 1,000 silver and gold coins thought to be minted in the Spanish colonies of Bolivia, Mexico and Peru were uncovered this summer off Florida’s Atlantic coast, 1715 Fleet – Queens Jewels LLC announced this week.

It’s not the first time the site has yielded a trove of, well, treasure.

Centuries ago, a fleet of Spanish ships laden with gold, silver and jewels taken from the New World was sailing back to Spain when a hurricane wrecked the flotilla on July 31, 1715, spilling the treasures into the sea, according to the 1715 Fleet Society.

This very interesting AP news item, with an embedded 1-minute video clip, showed up on the wsvn.com Internet site on Wednesday -- and I thank my Webmaster...the best one on the planet...Paul Raybould for sending it our way. Another link to it is here.

![]()

QUOTE of the DAY

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from past' features American singer, songwriter and musician Marty Balin. He was the co-founder of Jefferson Airplane way back in 1965...which morphed into Jefferson Starship ten years later. He left that band to go on his own in 1978 -- and this tune was by far his biggest solo hit. The link is here. There were surprisingly few bass covers to this -- and the best one I could find is linked here.

I'm two weeks late with today's classical 'blast from the past'...which dates from c. 1718-1723. It's Antonio Vivaldi's Violin Concerto No. 3 in F major, Op. 8, RV293...'Fall'. Here is the San Francisco-based 'Voices of Music' performing it to perfection -- and the link is here.

![]()

For the third time in as many days, the gold price was capped before it could cross the $3,900 spot mark. And for the second time in as many days, silver was hauled down and closed below $48 spot -- and also below that number in its current front month, which is December. But despite that, gold finished the week at another new all-time nominal high -- and silver at another 14+ year nominal high.

Both remain hugely overbought on their respective RSI traces. However, with more and more big money eyes now focusing on the precious metals as the stories in today's Critical Reads section indicate, this is a state of affairs that may not go away anytime soon.

And as I mentioned further up, it now appears obvious that not only are the powers-that-be micro-managing precious metals prices at the moment, but have also shown up in their associated equities, as nothing else could explain the share price action yesterday, or on other days recently. I've pointed this out multiple times over the last few weeks...but Friday's highly counterintuitive price action was the brightest of shiny examples of that.

Although platinum only closed higher by 31 dollars in the spot market, it closed up $46.70 in its current front month, which is now January. It finished the Friday session at a price not seen for 12+ years -- and back into overbought territory on its RSI trace. October is a scheduled delivery month for it -- and there have already been 4,085 contracts issued and stopped in it so far, which is a lot for this precious metal.

Palladium wasn't allowed to do much yesterday. The most it was allowed, was to gain back its engineered Thursday 'loss'...plus a tad more.

But Dr. Copper had another big day, as it closed higher by a further 12 cents at $5.03/pound -- and also back into overbought territory on its RSI trace. Ever since it blew through both its 200 and 50-day moving averages back on September 24, it's been on a tear.

Natural gas [chart included] had its second down day in a row, after being brutally hauled back below its 200-day moving average during Thursday's rally attempt. It was closed lower by a further 11 cents/3.11%...at $3.34/1,000 cubic feet.

And after four down days in a row, WTIC finally caught a bid -- and closed higher by a rather inconsequential 21 cent, as it finished the Friday trading session at $60.69/barrel...which is a dirt cheap price...which I have yet to see show up at the pumps around here.

Here are the 6-month charts for the Big 6+1 commodities...courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

For what it's worth, I received an e-mail from a friend of Ted Butler's that I keep in touch with -- and he informed me that..."I bought some silver 1,000 oz. bars from Silver Bullion in Singapore and there is a 4 week wait for delivery."

I remember pointing out last month that a large bullion dealer in the U.S. told me that he'd received a call from traders in New York looking for all the good delivery bars he had. He said it was the first time that had ever happened.

Neither of these straws in the wind should come as much of a surprise, as the demand for good delivery silver [and gold too] has become more rapacious with each passing month -- and now weeks.

Another straw in the wind was a Rick Rule interview I listened to the other day, where he correctly pointed out that normally the exploration companies and small junior producers are the last of the precious metal equities that see investment capital pour into them as a bull market in the precious metals progresses. Not this time around...au contraire!

This rising investment tide is lifting all boats at the same time. I can attest to that personally, as the three exploration companies that I threw money at in the last few months are already up big...one up 300 percent. That rising tide has also extended into exploration companies that I've held for years...with Bear Creek Mining and First Mining Gold being typical examples. And I'm still trying to wrap my head around why little Avino Silver & Gold Mines is up 533% year-to-date.

For all those reasons stated above, I'm surprised that the collusive commercial traders have been able to keep a lid on silver's price for as long as they have. Since its low tick on Monday, August 22...it has been allowed to rise by a bit more that ten dollars the ounce -- and if those traders hadn't fought it every step of the way, silver would be well north of $50/ounce already...if not in 3-digit territory.

The price pressure under silver and the other three precious metals is now immense -- and only going to get stronger. The poster child for that was the rapid recovery from their respective big engineered price declines on Thursday in COMEX trading in New York...an event which has been mostly forgotten already. Now it's just a matter of when, not if, they break out to the upside in a major way.

With the really big money now dipping its toe into the precious metals, it won't be long after that, that John Q. Public...always looking for the next big thing ...will pile in. As Ted Butler said years ago, anyone with a cell phone and a brokerage account...of which there are tens of millions, if not more...will hit the 'ask' on anything precious metals-related without hesitation.

At some point during this unfolding bull market, the shorts in the precious metals space...having already been bled white -- and facing financial ruin if they don't...will finally rush to cover. Then the mania phase will be on in earnest -- and as I've mentioned numerous times over the last year, Ted Butler's "Bonfire of the Silver Shorts" -- and his "Take it to the Limit" will go live. How the western financial powers-that-be respond when that moment arrives, will be of more than passing interest.

As I've stated many times over the years, nobody knows what the true free-market prices of gold and silver really are...but by the time this is all over, we'll know for sure.

In other news: First, the Ukraine/Russia war ramped up a notch or two, with the pending approval of the use of Tomahawk missiles in that conflict...second, a U.S. decapitation strike against Venezuela's president is imminent -- and lastly is the next U.S./Israeli strike on Iran. Sporting a new name...now "The U.S. Department of War"...the western globalist power elite are about to put that new moniker to good use...as they are now in ascendance. The situation is ripe for a false flag event of some kind, now more than ever.

And as I've also stated over the years -- and do so again now, is that when the precious metals in particular -- and most commodities in general, are finally set free from the paper shackles that they've been held in for generations...it won't happen in a news vacuum.

Such a stage has been set before and nothing has transpired, but I'm sure you'll forgive me for thinking 'that this time is most likely to be different'. The greatest 'everything bubble' in world history drones on...1929 on steroids...as the world's 50+ year fiat currency system circles the drain. What could possibly go wrong?

Of course, I'm still "all in" in the precious metals -- and, as always, will remain so to whatever end.

I'm done for the day -- and the week -- and I'll see you here on Tuesday.

Ed